Fintech

Tru Universe has significantly captured the attention of the Fintech industry through innovative payment programs and revolutionary prepaid solutions

MISSISSAUGA, ON / ACCESSWIRE / June 28, 2024 / The prepaid card industry is currently experiencing a dramatic surge as Tru Universe (Tru) positions itself at the forefront of customizable programs in the transportation, retail, influencer, and travel industries. As the company continues to embrace contactless payments and move away from cash transactions, demand for prepaid card programs continues to evolve. True Universe (Tru), a pioneering female-led Canadian Fintech, is on a mission to revolutionize the global payments landscape. By leveraging a unified payment platform, Tru Universe aims to modernize transactions, reduce costs and improve brand presence.

Photo credit: Nikko Pangilinan

“I love the variety of wellness initiatives Tru Universe offers our customers,” He says Lisette Anciaes Senior Program Director at Tru Universe. “By participating in programs like the LA Metro Mobility Wallet, where low-income families have access to transportation, or timeshares, where programs can be built to benefit multiple individuals at once.”

Navigating the prepaid sector requires a Qualified internal team to ensure smooth operations. At Tru Universe, this commitment is evident through a team that works closely with customers, maintaining a seamless experience. More than just building a payment platform, the experts at Tru Universe are experts in creating tailor-made marketing solutions and incentive strategies.

Having a dedicated team of passionate people has been instrumental in Tru Universe’s success, and the results are clear to see. In the last two years, Tru Universe has doubled in size, expanded into multiple industries, and continues to grow into more territories around the world.

Influencers

Influencer marketing is growing exponentially, which is key to increasing brand visibility and engagement. Tru Universe’s partnership with Black’s™ hasn’t stopped this holiday season combine influencer marketing with a personalized Virtual Prepaid Card, which leads to better product reviews. Influencers praise the Tru Universe card for making shopping easier and improving promotional efforts, highlighting Tru’s expertise in creating effective marketing solutions and driving business growth.

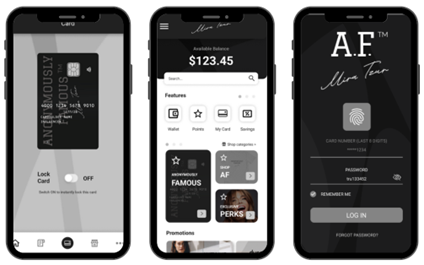

In this current market, where influencers influence social media metrics, TruUniverse introduces its own prepaid Influencer wallet app. aka Anonymously Famous™️/AF Visa card. Driven by Mira TzurSenior Vice President of Tru Universe, the initiative includes a loyalty/rewards program, inviting talent agencies and brand partners to create a customized business payment channel.

“Simplifying the payment platform for freelancers working for agencies has been an overlooked problem that needs attention. To solve this problem, the innovative Wallet app has been a game changer. It’s better than anything that’s ever been done before and It’s exciting to implement,” says Mira TzuR, Senior Vice President at TruUniverse.

Transport

Tru Universe is reshaping public transportation through its global subway system partnerships, addressing traffic congestion, environmental impact and community engagement. Initiatives like the Mobility Portfolio (MW) in Los Angeles provide prepaid debit cards for both public and private transportation, significantly improving the quality of life of program users. This positions Tru Universe as a pioneer in transportation solutions.

See in detail

Tru Universe retail solutions stand out for their Customizable and carefully crafted prepaid card programs. These initiatives are strategically designed to increase customer engagement and drive sales, while offering significant value to both buyers and property managers. Through personalized branding and tailored rewards, Tru Universe cultivates lasting brand loyalty and facilitates long-term success for property management companies, collaborating with some of the biggest in the industry.

“The retail landscape is rapidly transforming and Tru is committed to leading the charge by continually evolving our payment solutions. We recognize the growing demand for seamless omnichannel experiences,” He says Junius ChengSenior Director, Strategy and Business Enablement. “We are committed to developing and redefining to be compatible with these innovative technologies that enable retailers to meet this demand. At the same time, we remain vigilant in navigating the complexities of regulatory requirements and ensuring the security of every transaction.”

Timeshare

For timeshares, part of the travel industry, Tru Universe’s innovative marketing strategies provide 3 different prepaid incentive programs to attract potential buyers, fostering positive brand perception. Tour Incentive Program encourages prospects to attend sales presentations/tours by offering pre-paid rewards, reinforcing the company’s dedication to excellent customer service. Additionally, Owner referral program sparks conversations about the brand because existing customers are encouraged to spread the word, while the Employee incentive program offers rewards to existing staff who recruit new talent. With these innovative prepaid incentive programs, Tru is reshaping the timeshare industry, igniting customer interest and increasing sales.

Tru Universe’s commitment to innovation and customer satisfaction continues to drive the evolution of the prepaid card industry, setting new standards in efficiency, convenience and customer engagement.

For media inquiries, please contact:

Vicky Talbot

Vice President of Media/PR Agency

Phone: 315-412-9427

E-mail: [email protected]

About Tru Universe:

Link to follow Tru Universe:

Instagram: @truuniverseco

LinkedIn: @truincco

Website: Italian: https://truuniverse.com/

Tru Universe is a Canadian-based FinTech company committed to disrupting the global payments landscape. With a focus on innovation and customer satisfaction, Tru Universe offers cutting-edge prepaid card solutions, tailored to meet the evolving needs of businesses and consumers around the world.

https://usreporter.com/teamwork-makes-the-dream-work-at-tru-universe/

https://usbusinessnews.com/transit-get-rewarded-by-truuniverses-cards/

https://usinsider.com/truuniverse-tru-introduces-its-prepaid-loyalty-platform/

https://realestatetoday.com/tru-universes-profitti-da-record-per-i-gestori-immobiliari/

https://worldreporter.com/trus-partnership-with-blacks-uses-influ

https://finance.yahoo.com/news/anonymously-famous-tm-brand-developed-185000071.html

https://usinsider.com/il-mondo-delle-multiproprietà-e-le-strategie-di-marketing-innovative/

SOURCE: True Universe

Fintech

Lloyds and Nationwide invest in Scottish fintech AI Aveni

Lloyds Banking Group and Nationwide have joined an £11m Series A funding round in Scottish artificial intelligence fintech Aveni.

The investment is led by Puma Private Equity with additional participation from Par Equity.

Aveni creates AI products specifically designed to streamline workflows in the financial services industry by analyzing documents and meetings across a range of operational functions, with a focus on financial advisory services and consumer compliance.

The cash injection will help fund the development of a new product, FinLLM, a large-scale language model created specifically for the financial sector in partnership with Lloyds and Nationwide.

Joseph Twigg, CEO of Aveni, explains: “The financial services industry doesn’t need AI models that can quote Shakespeare, it needs AI models that offer transparency, trust and, most importantly, fairness. The way to achieve this is to develop small, highly tuned language models, trained on financial services data, vetted by financial services experts for specific financial services use cases.

“FinLLM’s goal is to set a new standard for the controlled, responsible and ethical adoption of generative AI, outperforming all other generic models in our selected financial services use cases.”

Robin Scher, head of fintech investment at Lloyds Banking Group, says the development programme offers a “massive opportunity” for the financial services industry by streamlining operations and improving customer experience.

“We look forward to supporting Aveni’s growth as we invest in their vision of developing FinLLM together with partners. Our collaboration aims to establish Aveni as a forerunner in AI adoption in the industry, while maintaining a focus on responsible use and customer centricity,” he said.

Fintech

Fairexpay: Risk consultancy White Matter Advisory acquires 90% stake in fintech Fairexpay

Treasury Risk Consulting Firm White Matter Alert On Monday he announced the acquisition of a 90% stake in the fintech startup Fair payment for an undisclosed amount. The acquisition will help White Matter Advisory expand its portfolio in the area of cross-border remittance and fundraising services, a statement said. White Matter Advisory, which operates under the name SaveDesk (White Matter Advisory India Pvt Ltd), is engaged in the treasury risk advisory business. It oversees funds under management (FUM) totaling $8 billion, offering advisory services to a wide range of clients.

Improve your technology skills with high-value skills courses

| IIT Delhi | Data Science and Machine Learning Certificate Program | Visit |

| Indian School of Economics | ISB Product Management | Visit |

| MIT xPRO | MIT Technology Leadership and Innovation | Visit |

White Matter Advisory, based in Bangalore, helps companies navigate the complexities of treasury and risk management.

Fairexpay, authorised by the Reserve Bank of India (RBI) under Cohort 2 of the Liberalised Remittance Scheme (LRS) Regulatory Sandbox, boasts features such as best-in-class exchange rates, 24-hour processing times and full security compliance.

“With this acquisition, White Matter Advisory will leverage Fairexpay’s advanced technology platform and regulatory approvals to enhance its services to its clients,” the release reads.

The integration of Fairexpay’s capabilities should provide White Matter Advisory with a competitive advantage in the cross-border remittance and fundraising market, he added.

The release also states that by integrating Fairexpay’s advanced technology, White Matter Advisory aims to offer seamless and convenient cross-border payment solutions, providing customers with secure options for international money transfers.

Fintech

Rakuten Delays FinTech Business Reorganization to 2025

Rakuten (Japan:4755) has released an update.

Rakuten Group, Inc. and Rakuten Bank, Ltd. announced a delay in the reorganization of Rakuten’s FinTech Business, moving the target date from October 2024 to January 2025. The delay is to allow for a more comprehensive review, taking into account regulatory, shareholder interests and the group’s optimal structure for growth. There are no anticipated changes to Rakuten Bank’s reorganization objectives, structure or listing status outside of the revised timeline.

For more insights on JP:4755 stock, check out TipRanks Stock Analysis Page.

Fintech

White Matter Advisory Acquires 90% Stake in Fintech Startup Fairexpay

You are reading Entrepreneur India, an international franchise of Entrepreneur Media.

White Matter Advisory, which operates under the name SaveDesk in India, has announced that it is acquiring a 90% stake in fintech startup Fairexpay for an undisclosed amount.

This strategic move aims to strengthen White Matter Advisory’s portfolio in cross-border remittance and fundraising services.

By integrating Fairexpay’s advanced technology, White Matter Advisory aims to offer seamless and convenient cross-border payment solutions, providing customers with secure options for international money transfers.

White Matter Advisory, known for its treasury risk advisory services, manages funds under management (FUM) totaling USD 8 billion.

Founded by Bhaskar Saravana, Saurabh Jain, Kranthi Reddy and Piuesh Daga, White Matter Advisory helps companies effectively manage the complexities of treasury and risk management.

The SaveDesk platform offering includes a SaaS-based FX market data platform with real-time feeds for over 100 currencies, bank cost optimization services, customized treasury risk management solutions, and compliance guidance for the Foreign Exchange Management Act (FEMA) and other trade regulations.

Fairexpay is a global aggregation platform offering competitive currency exchange rates from numerous exchange partners worldwide. Catering to both private and corporate customers, Fairexpay provides seamless money transfer solutions for education, travel and immigration, as well as simplifying cross-border payments via API and white-label solutions for businesses. Key features include competitive currency exchange rates, 24-hour processing times, extensive currency coverage of over 30 currencies in more than 200 countries, and secure, RBI-compliant transactions.

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News1 year ago

News1 year agoLatest Business News Live Updates Today, July 11, 2024

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Fintech12 months ago

Fintech12 months agoFinTech LIVE New York: Mastercard and the Power of Partnership

-

DeFi12 months ago

DeFi12 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

Fintech1 year ago

Fintech1 year ago121 Top Fintech Companies & Startups To Know In 2024

-

ETFs1 year ago

ETFs1 year agoGold ETFs see first outing after March 2023 at ₹396 cr on profit booking

-

Fintech1 year ago

Fintech1 year agoFintech unicorn Zeta launches credit as a UPI-linked service for banks

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

News1 year ago

News1 year agoSalesforce Q1 2025 Earnings Report (CRM)

-

ETFs1 year ago

ETFs1 year agoLargest US Bank Invests in Spot BTC ETFs While Dimon Remains a Bitcoin Hater ⋆ ZyCrypto