ETFs

BlackRock Adds Max Buffer ETF to Its Active ETF Platform

Expands access to options strategies in the convenience of an ETF

Includes the most affordable buffer ETF that targets up to 100% downside protection1

NEW YORK, July 1, 2024–(BUSINESS THREAD)–BlackRock has bolstered its active ETF platform with a series of buffer ETFs that aim to provide investors with exposure to the growth potential of stocks while seeking to maximize downside protection. The first in the series – the iShares Large Cap Max Buffer ETF June (Cboe: MAXJ) launched today, making it the most affordable maximum buffer ETF targeting up to 100% downside protection in the market.1

“With record levels of cash on hold2, many investors are looking for tools to help them manage market volatility before returning to the market,” said Rachel Aguirre, Head of US iShares Product at BlackRock“iShares Max Buffer ETFs simplify access to traditional institutional risk management strategies through the convenience of ETF packaging, providing investors with resilient portfolio tools to help them stay invested through any market cycle.”

Product innovation expands long-term investors’ toolbox

Using a combination of options, the iShares Large Cap Max Buffer ETFs (Max Buffer ETFs) seek to track the share price performance of the underlying ETF, the iShares Core S&P 500 ETF (IVV), up to an approximate upside cap, while seeking to provide up to an approximate 100% buffer against IVV losses for each applicable hedge period.

The Max Buffer ETFs are expected to launch over a one-year period beginning at the end of each quarter, with the cap resetting for each fund upon expiration of the option at the end of each one-year period.

Designed as buy-and-hold strategies, Max Buffer ETFs are the latest additions to BlackRock’s results-oriented product suite, which includes two Buffer ETFs launched last year and a suite of BuyWrite fixed income and equity ETFs. BlackRock now manages $25 billion in assets under management across more than 40 active ETFs in the U.S.3

|

Fund name |

Reference asset |

Buffer down |

Expense ratio* |

Coverage period |

Expected launch date |

|

|

Raw |

Net |

|||||

|

iShares Large Cap Max Buffer ETF June (Cboe: MAXJ) |

S&P 500 (ETF IVV) |

100% |

0.53% |

0.50% |

From July 1st to June 30th |

July 1, 2024 |

|

ETF iShares Large Cap Max Buffer Sep (Cboe: SMAX) ** |

S&P 500 (ETF IVV) |

100% |

0.53% |

0.50% |

From October 1st to September 30th |

October 1, 2024 |

|

iShares Large Cap Max Buffer Dec ETF (Cboe: DMAX) ** |

S&P 500 (ETF IVV) |

100% |

0.53% |

0.50% |

From January 1st to December 31st |

January 2, 2025 |

|

iShares Large Cap Max Buffer Mars ETF (Cboe: MMAX) ** |

S&P 500 (ETF IVV) |

100% |

0.53% |

0.50% |

From April 1st to March 31st |

April 1, 2025 |

*BlackRock, as of June 30, 2024. The net expense ratio shown reflects a contractual fee waiver in effect through November 30, 2029.

The story continues

**A registration statement has been filed for the Fund and the registration statement has become effective. However, shares of the Fund are not yet available for purchase or sale. Consider the Fund’s investment objectives, risk factors, and charges and expenses carefully before investing. This and other information can be found in the Fund’s prospectus, which can be obtained by visiting the SEC’s website, by visiting www.iShares.com prior to launch or by calling 1-800-iShares (1-800-474-2737). Read the prospectus carefully before investing.

Before investing, carefully consider the investment objectives, risk factors and charges and expenses of the Funds. This and other information can be found in the Funds’ prospectuses or, if available, in summary prospectuses which can be obtained by visiting www.iShares.com Or www.blackrock.comRead the prospectus carefully before investing. Investing involves risks, including the risk of not getting back the principal invested.

There can be no assurance that the Fund will be successful in its strategy of providing downside protection to the underlying ETFs. The Fund does not provide capital protection or non-capital protection and, despite the approximate margin of safety (the “Margin of Safety”), an investor may experience significant losses on his or her investment, including the loss of his or her entire investment. A mixed portfolio of expired and new options during a rebalancing period will impact the Fund’s ability to take full advantage of the Margin of Safety or may subject the Fund’s performance to an upside limit that is slightly below or above the approximate cap (the “Cap”) for the applicable hedging period. As a result, investors may experience losses against which the Margin of Safety is intended to protect and be subject to an upside limit that is less than the Cap. In the event an investor purchases shares of the Fund after the start of a hedging period or sells shares of the Fund before the end of the hedging period, the returns realized by the investor will not match those that the Fund seeks to provide. During periods of extreme market volatility, the Fund’s performance may be subject to downside protection that is significantly less than the buffer and upside protection that is significantly less than the cap. A new cap is set during each rebalancing period and is dependent on current market conditions. As such, the cap is likely to change, sometimes significantly, from one hedging period to the next. The Fund invests in FLEX options that derive their value from the underlying ETF. FLEX options are subject to counterparty risk, which is the risk that the other party to the transaction will not fulfill its contractual obligations, and may be less liquid than other securities. The value of FLEX options may be affected by changes in interest rates, dividends, actual and implied volatility levels in the underlying ETF’s share price and the time remaining until expiration of the FLEX options. As a result of these factors, the Fund’s net asset value may not increase or decrease at the same rate as the underlying ETF’s share price.

The Fund is actively managed and does not seek to replicate the performance of any specified index, may have a higher portfolio turnover rate and may charge higher fees than index funds due to increased trading and research expenses.

An investment in ETFs is not equivalent to an investment in cash and may involve significant risks not associated with an investment in cash.

This information should not be considered research, investment advice or recommendations regarding any particular product, strategy or security. This material is provided for informational, educational or illustrative purposes only and is subject to change.

Buying and selling ETF shares may incur brokerage commissions.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc. or its affiliates. All rights reserved. BLACKROCK® And iShares are registered trademarks of BlackRock, Inc. or its affiliates. All other trademarks are the property of their respective owners.

Not FDIC insured. May lose value. No bank guarantee.

BlackRock, Inc.,

50 Hudson Yards, New York, NY 10001

________________________

|

1 BlackRock and Morningstar, as of June 20, 2024, based on a review of all 100% Max Buffer ETFs in the Morningstar Category “US Funds Options Trading.” The fund seeks to provide a 100% downside buffer against price declines in the underlying over the one-year period, before fees and expenses, if held for the entire hedge period. |

|

2 Bank of America, May 2024. |

|

3 BlackRock, as of June 30, 2024 |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240701314323/en/

Contacts

MEDIA CONTACT

Joanna Yau

Joanna.Yau@BlackRock.com

646.856.7274

ETFs

Missed the Bull Market Resumption? 3 ETFs to Help You Build Wealth for Decades

The market’s rebound from the 2022 bear market was not only unexpected. It was also bigger than expected. S&P 500 The stock price is up 60% from the bear market low, despite no clear signs at the time that such a rally was in the works. Chances are you missed at least part of this current rally.

If so, don’t be discouraged: you’re in good company. You’re also far from financially ruined. While you can’t go back and make up for the missed opportunity, for long-term investors, the growth potential is much greater.

If you want to make sure you don’t miss the next big bull run, you might want to tweak your strategy a bit. This time around, you might try buying fewer stocks and focusing more on exchange traded funds (or ETFs), which are often easier to hold when things get tough for the overall market.

With that in mind, here’s a closer look at three very different ETFs to consider buying that could – collectively – complement your portfolio brilliantly.

Let’s start with the basics: dividend growth

Most investors naturally favor growth, choosing growth stocks to achieve that goal. And the strategy usually works. However, most long-term investors may not realize that they can get the same type of net return with boring dividend stocks like the ones held in the portfolio. Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) which reflects the S&P US Dividend Growth Index.

As the name suggests, this Vanguard fund and its underlying index hold stocks that not only pay consistent dividends, but also have a history of consistently increasing dividends. To be included in the S&P US Dividend Growers Index, a company must have increased its dividend every year for at least the past 10 years. In most cases, however, they have been doing so for much longer.

The ETF’s current dividend yield of just under 1.8% isn’t exactly exciting. In fact, it’s so low that investors might wonder how this fund is keeping up with the broader market, let alone growth stocks. What’s being grossly underestimated here is the sheer magnitude of these stocks. dividend growthOver the past 10 years, its dividend per share has nearly doubled, and more than tripled from 15 years ago.

The reason is that solid dividend stocks generally outperform their non-dividend-paying counterparts. Calculations by mutual fund firm Hartford indicate that since 1973, S&P 500 stocks with a long history of dividend growth have averaged a single-digit annual return, compared with a much more modest 4.3% annual gain for non-dividend-paying stocks, and an average annual return of just 7.7% for an equal-weighted version of the S&P 500. The numbers confirm that there’s a lot to be said for reliable, consistent income.

The story continues

Then add capital appreciation through technology

That said, there’s no particular reason why your portfolio can’t also hold something a little more volatile than a dividend-focused holding. If you can stomach the volatility that’s sure to continue, take a stake in the Invesco QQQ Trust (NASDAQ: QQQ).

This Invesco ETF (often called the “cubes” or the triple-Q) is based on the Nasdaq-100 index. Typically, this index consists of 100 of the Nasdaq Composite IndexThe index is one of the largest non-financial indices at any given time. It is updated quarterly, although extreme imbalance situations may result in unplanned rebalancing of the index.

That’s not what makes this fund a must-have for many investors, though. It turns out that most high-growth tech companies choose to list their shares through the Nasdaq Sotck exchange rather than other exchanges like the New York Stock Exchange or the American Stock ExchangeNames like Apple, MicrosoftAnd Nvidia are not only Nasdaq-listed securities. They are also the top holdings of this ETF, with Amazon, Meta-platformsand Google’s parent company AlphabetThese are of course some of the highest-yielding stocks on the market in recent years.

This won’t always be the case. Just as companies like Nvidia and Apple have squeezed other names out of the index to make room for their stocks, these current names could also be replaced by other names (although it will likely be a while before that happens). It’s the proverbial life cycle of the market.

This shift, however, will likely be driven by technology companies that are offering revolutionary products and services. Owning a stake in the Invesco QQQ Trust is a simple, low-cost way to ensure you’re invested in at least most of their stocks at the perfect time.

Don’t forget indexing, but try a different approach

Finally, while Triple-Q and Vanguard Dividend Appreciation funds are smart ways to diversify your portfolio over the long term, the good old indexing strategy still works. In other words, rather than risk underperforming the market by trying to beat it, stick to tracking the long-term performance of a broad stock index.

Most investors will opt for something like the SPDR S&P 500 Exchange Traded Fund (NYSEMKT:SPY), which of course mirrors the large-cap S&P 500 index. And if you already own one, great: stick with it.

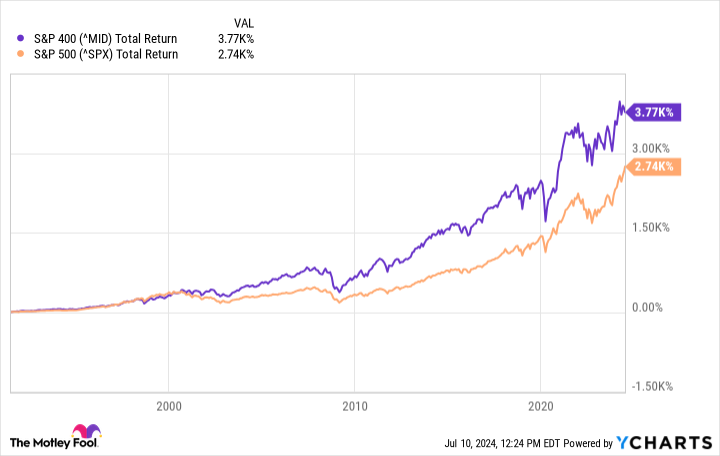

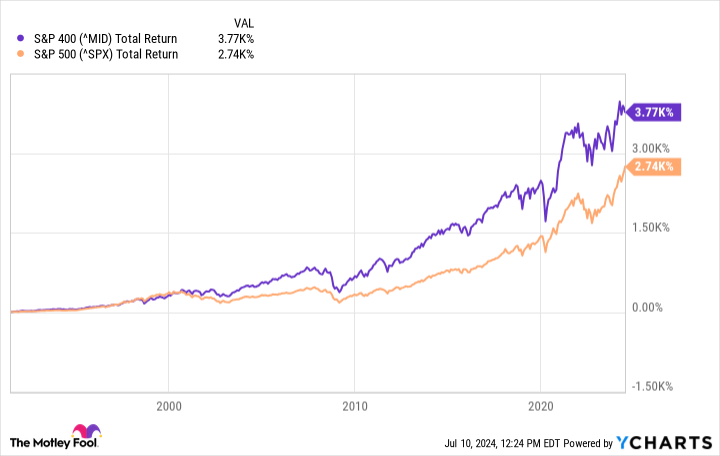

If and when you have some spare cash to put to good use, consider starting a mid-cap funds as the iShares Core S&P Mid-Cap ETF (NYSEMKT: IJH) instead. Why? Because you’ll likely get better results with this ETF than you will with large-cap index funds. Over the past 30 years, S&P 400 Mid-Cap Index significantly outperformed the S&P 500.

^MID Chart

The disparate degree of gains actually makes sense. While no one disputes the solid foundations on which most S&P 500 companies are built, they are in many ways victims of their own size: It’s hard to get bigger when you’re already big. This is in contrast to the mid-cap companies that make up the S&P 400 Mid Cap Index. These organizations have moved past their rocky, shaky early years and are just entering their era of high growth. Not all of them will survive this phase, but companies like Advanced microsystems And Super microcomputer Those that survive end up being incredibly rewarding to their patient shareholders.

Should You Invest $1,000 in iShares Trust – iShares Core S&P Mid-Cap ETF Right Now?

Before purchasing shares of iShares Trust – iShares Core S&P Mid-Cap ETF, consider the following:

The Motley Fool Stock Advisor analyst team has just identified what they believe to be the 10 best stocks Investors should buy now…and the iShares Trust – iShares Core S&P Mid-Cap ETF wasn’t one of them. The 10 stocks selected could generate monstrous returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio construction advice, regular analyst updates, and two new stock picks each month. The Stock Advisor service offers more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

John Mackey, former CEO of Amazon’s Whole Foods Market, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Specialized Funds – Vanguard Dividend Appreciation ETF. The Motley Fool recommends Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a position in Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Vanguard Specialized Funds – Vanguard Dividend Appreciation ETF. The Motley Fool recommends Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. disclosure policy.

Missed the Bull Market Resumption? 3 ETFs to Help You Build Wealth for Decades was originally published by The Motley Fool

ETFs

This Simple ETF Could Turn $500 a Month Into $1 Million

This large-cap ETF offers investors the potential for above-market returns while minimizing risk.

It’s always inspiring to hear stories of people who invested in a company and made tons of money as the company grew and became successful. While these stories are a testament to the power of investing, they can also be misleading. That’s not because it doesn’t happen often, but because you don’t have to make a big splash on a single company to make a lot of money in the stock market.

Invest regularly in exchange traded funds (AND F) is a great way to build wealth. ETFs allow you to invest in dozens, hundreds, and sometimes thousands of companies in a single investment. For investors looking for an ETF that can help them become millionaires, look no further than the Vanguard Growth ETFs (VUG 0.61%).

A history of outperforming the market

Since its launch in January 2004, this ETF has outperformed the market (based on S&P 500 Back), with an average total return of around 11.6%. The returns are even more impressive when looking back over the past decade, with the ETF posting an average total return of around 15.7%.

Total VUG Performance Level data by YCharts

The ETF’s past success doesn’t mean it will continue on this path, but for the sake of illustration, let’s take a middle ground and assume it averages about 13% annual returns over the long term. Averaging those returns, monthly investments of $500 could top the $1 million mark in just over 25 years.

Assuming (emphasis on the word “assume”) that the ETF continues to generate an average total return of 15.7% over the past decade, investing $500 a month could get you past $1 million in about 23 years. At an annual return of 11.6%, that would take nearly 28 years.

There is no way to predict the future performance of the ETF, but the most important thing is the power of time and Compound profit. Earning $1 million by saving alone is a difficult and unachievable task for most people. However, it becomes much more achievable if you give yourself time and make regular investments, no matter how small.

So why choose the Vanguard Growth ETF?

This ETF can offer investors the best of both worlds. On the one hand, since it only contains large cap stocksIt offers more stability and less volatility than you typically find with smaller growth stocks. At the other end, the focus on growth means it is built with the goal of outperforming the market.

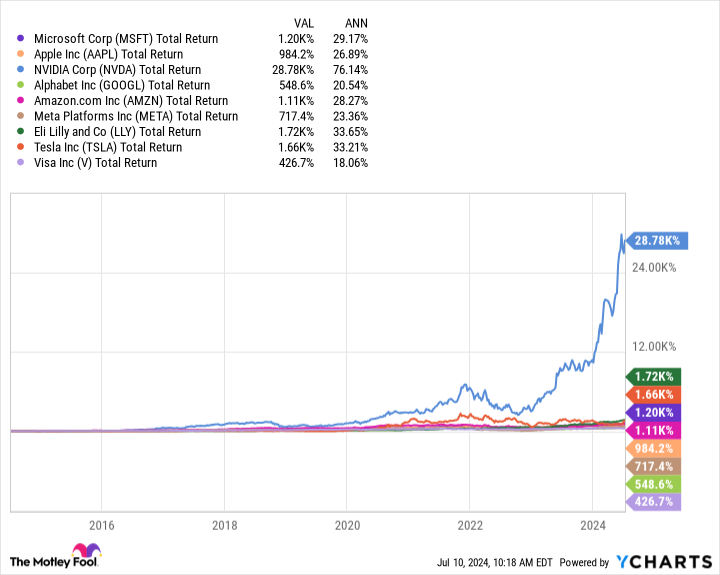

Investing involves a tradeoff between risk and return, and this ETF falls somewhere in the middle for the most part. That’s not just because it only contains large-cap stocks. It’s also because large-cap stocks are leading the way. Here are the ETF’s top 10 holdings:

- Microsoft: 12.60%

- Apple: 11.51%

- Nvidia: 10.61%

- Alphabet (both share classes): 7.54%

- Amazon: 6.72%

- Meta-platforms: 4.21%

- Eli Lilly: 2.88%

- You’re here: 1.98%

- Visa: 1.72%

The Vanguard Growth ETF is not as diversified as other broad ETFs, with the top 10 holdings making up nearly 60% of the fund and the “The Magnificent Seven” with stocks accounting for about 55%. However, many of these companies (particularly mega-cap technology stocks) have been among the best performers in the stock market over the past decade and still have great growth opportunities ahead of them.

MSFT Total Return Level data by YCharts

Big tech stocks are expected to continue to see growth in areas such as cloud computing, artificial intelligenceand cybersecurity; Eli Lilly will benefit from advances in biotechnologyTesla is one of the leaders in electric vehicles, which are still in the early stages of development; and Visa is expected to be one of the forerunners as the world moves toward more digital payments.

ETF concentration adds risk, especially if Microsoft, Apple or Nvidia is experiencing a slowdownBut these companies are well positioned to drive long-term growth despite any short-term setbacks that may arise. Consistent investments over time in the Vanguard Growth ETF should pay off for investors.

Randi Zuckerberg, former head of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a position in shares of Apple and Microsoft. disclosure policy.

ETFs

Ethereum ETFs Could Bring in $1 Billion a Month

In a recent interview with Bloomberg, Kraken’s chief strategy officer Thomas Perfumo predicted that Ethereum ETFs could attract between $750 million and $1 billion in monthly investments.

“Market sentiment is being priced in. I think the market has priced in something like $750 million to $1 billion of net inflows into Ethereum ETF products each month,” Perfumo said.

In the interviewPerfumo noted that if inflows exceed expectations, it could provide strong support to the industry and potentially drive Ethereum to new record highs.

This creates positive support for the industry, if we go beyond that, note that Bitcoin was at a rate above $2.5 billion

He said

Moreover, the hype around Ethereum ETFs has already sparked some optimism among investors. After the SEC approved the 19b-4 filing, Ethereum’s price jumped 22%, attracting investment into crypto assets.

This price movement shows how sensitive the market is to regulatory changes and the growth potential once ETFs are approved.

Perfumo also highlighted other factors supporting current market sentiment, including the upcoming US elections and a potential interest rate cut by the Federal Reserve. Recent US CPI data suggests disinflation on a monthly and annual basis, with some traditional firms predicting rate cuts as early as September.

These broader economic factors, combined with developments in the crypto space, are shaping the overall market outlook.

Regarding Kraken’s strategy, Perfumo highlighted the exchange’s goal of driving cryptocurrency adoption through strategic initiatives. When asked about rumors of Kraken going public, he reiterated that the company’s intention is instead to broaden cryptocurrency adoption.

Read also : Invesco, Galaxy Cut Ether ETF Fees to 0.25% in Competitive Market

ETFs

Kraken Executive Expects Ethereum ETF Launch to “Lift All Boats”

Kraken Chief Strategy Officer Thomas Perfumemo said: Ethereum ETFs (ETH) could help the crypto sector while commenting on political developments in the United States.

On July 12, Perfumo told Bloomberg that spot Ethereum ETFs would attract capital flows while drawing attention to crypto, noting:

“It’s a rising tide, which lifts the whole history of the boat.”

Perfumo further explained that the final value of Ethereum “depends on the Ethereum ETF.”

He said the cryptocurrency market is “pricing in” between $750 million and $1 billion in net inflows into Ethereum products on a monthly basis, which would imply that Ethereum could reach all-time highs between $4,000 and $5,000.

Perfumo also compared expectations to Bitcoin’s all-time high in March, which he called a “silent spike” that occurred without any evidence of millions of new investors entering the industry.

Political evolution

Perfumo also commented on political developments. At the beginning of the interview, he said that the results of the US elections “will set the tone for policymaking and the legislative agenda for the next four years.”

He also stressed the importance of legislative action and clarity and noted that recent developments show bipartisan support in Congress.

The House recently voted to pass the Financial Innovation and Technology for the 21st Century Act (FIT21) and attempted to repeal controversial SEC accounting rules with the Senate. However, the president Joe Biden Chosen to veto The resolution.

Perfume said:

“Even if you encounter obstacles at the executive level, [there’s] “There is still good progress to come.”

He added that the Republican Party appears “more pro-crypto.” [and] “more progressive” on the issue, noting Donald Trump plans to attend the Bitcoin Conference in Nashville.

Trump has also made numerous statements in support of pro-crypto policy, including at recent campaign events in Wisconsin And San Francisco.

Mentioned in this article

-

DeFi12 months ago

DeFi12 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News1 year ago

News1 year agoLatest Business News Live Updates Today, July 11, 2024

-

DeFi12 months ago

DeFi12 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Fintech12 months ago

Fintech12 months agoFinTech LIVE New York: Mastercard and the Power of Partnership

-

DeFi12 months ago

DeFi12 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

Fintech1 year ago

Fintech1 year ago121 Top Fintech Companies & Startups To Know In 2024

-

ETFs1 year ago

ETFs1 year agoGold ETFs see first outing after March 2023 at ₹396 cr on profit booking

-

Fintech1 year ago

Fintech1 year agoFintech unicorn Zeta launches credit as a UPI-linked service for banks

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

News1 year ago

News1 year agoSalesforce Q1 2025 Earnings Report (CRM)

-

ETFs1 year ago

ETFs1 year agoLargest US Bank Invests in Spot BTC ETFs While Dimon Remains a Bitcoin Hater ⋆ ZyCrypto