DeFi

Tendances des attaques cryptographiques au deuxième trimestre 2024 : changement de CeFi, empoisonnement d’adresses

Alors que le deuxième trimestre 2024 touche à sa fin, l’écosystème Web3 évolue dans un environnement en constante évolution. sécurité environnement. Ce trimestre a été témoin d’un changement significatif dans les vecteurs d’attaque. Les échanges centralisés (CEX) ont été les plus touchés par les incidents majeurs, tandis que la finance décentralisée (DeFi) les protocoles ont montré une résilience améliorée.

Un rapport de la société de sécurité blockchain Cyvers fournit une analyse détaillée des incidents de sécurité. Le rapport met en évidence leur impact sur divers segments, les changements dans les tactiques des hackers et les répercussions économiques de ces incidents.

Les cybermenaces croissantes propulsent les pertes de cryptomonnaies vers de nouveaux sommets en 2024

Le rapport de sécurité Web3 de Cyvers pour le deuxième trimestre et le premier semestre 2024 révèle une augmentation spectaculaire des pertes de crypto-monnaies dues aux cyberattaques. Le rapport note des événements notables, des changements de stratégies d’attaque et des effets financiers et opérationnels sur l’écosystème Web3. Malgré l’augmentation des attaques, les efforts de récupération et les stratégies de réponse aux incidents se sont améliorés, montrant la nécessité d’une vigilance continue et de mesures de sécurité solides.

Au deuxième trimestre 2024, 629,68 millions de dollars de pertes en cryptomonnaies ont été enregistrées à travers 49 incidents, portant le total depuis le début de l’année à un montant stupéfiant de 1,38 milliard de dollars au premier semestre 2024. Ce chiffre montre une augmentation notable par rapport à la même période en 2023, soulignant ainsi le caractère continu et changeant des menaces dans l’environnement Web3.

En savoir plus: 15 escroqueries cryptographiques les plus courantes auxquelles il faut faire attention

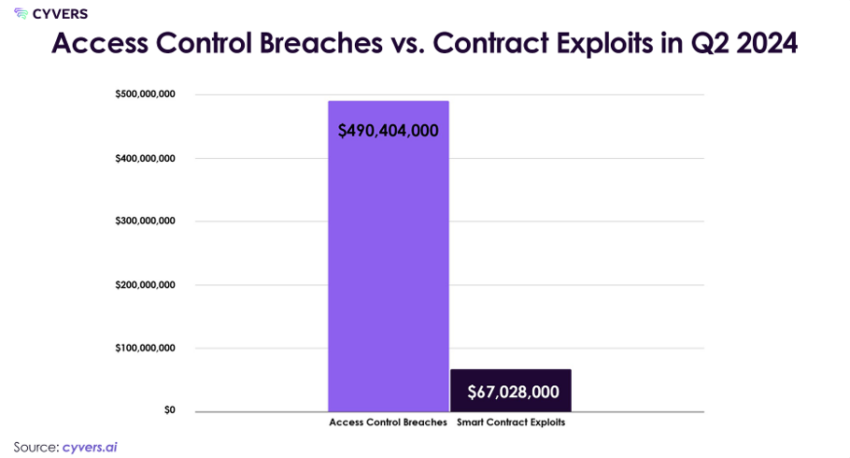

Les exploits de contrats intelligents ont représenté 67 378 000 $ sur 20 incidents, tandis que les violations du contrôle d’accès ont entraîné des pertes de 491 311 000 $ sur 26 incidents. En outre, l’empoisonnement d’adresses a représenté 71 475 000 $ sur les 361 incidents. L’augmentation des pertes d’une année sur l’autre montre une augmentation de plus de 100 % par rapport au deuxième trimestre 2023.

« Il convient de noter que le montant des fonds récupérés a augmenté de près de 42 %, passant de 138 900 000 $ au deuxième trimestre 2023 à 197 000 000 $ au deuxième trimestre 2024. Cette augmentation notable souligne la valeur des techniques de réponse solides et des efforts de récupération améliorés », a déclaré l’équipe de Cyvers à BeInCrypto.

Impact des piratages de cryptomonnaies au deuxième trimestre : surveillance réglementaire et hausse des coûts

Mais les pertes vont au-delà des chiffres. Les problèmes de sécurité du deuxième trimestre ont eu un impact important et considérable sur l’économie.

Les piratages très médiatisés de CEX ont intensifié la surveillance réglementaire, ce qui pourrait entraîner des exigences de conformité plus strictes et des coûts opérationnels plus élevés pour les bourses. Alors que les entreprises concernées intentent des poursuites judiciaires contre les contrevenants, ces événements ont également sérieusement terni leur réputation et augmenté les frais juridiques.

En outre, les coûts de fonctionnement des projets Web3 sont aggravés par la fréquence et l’ampleur des attaques, qui ont fortement augmenté les tarifs d’assurance des cryptomonnaies. Les failles de sécurité fréquentes pourraient miner la confiance des utilisateurs, réduisant ainsi les taux d’adoption et d’investissement dans l’espace Web3.

Le rapport trimestriel de l’équipe Cyvers a également souligné les tendances géographiques des menaces de cybersécurité du Web3. L’Europe de l’Est a connu une augmentation de l’activité, tandis que les échanges centralisés de l’Asie-Pacifique ont été confrontés à des attaques ciblées en raison de lacunes réglementaires et de lois de cybersécurité plus faibles. D’autre part, les protocoles DeFi nord-américains ont montré une résilience accrue, probablement en raison de mesures de sécurité et de conformité strictes.

DeFi vs. CeFi : Comparaison de l’impact des récentes attaques cryptographiques

Au deuxième trimestre 2024, les failles de sécurité ont connu une évolution notable vers des incidents de contrôle d’accès, ciblant en particulier les échanges centralisés. Cela a marqué un éloignement de l’exploitation des vulnérabilités des contrats intelligents dans les protocoles DeFi. Les exploits de contrôle d’accès ont augmenté de 35 %, tandis que les exploits de contrats intelligents ont diminué de 83 % par rapport au premier semestre 2023.

CEX est responsable de plus de 65 % des pertes globales. Source : Cyvers

L’augmentation spectaculaire de 900 % des pertes du CeFi par rapport au deuxième trimestre 2023 signale un changement significatif dans l’orientation des attaquants. Cette tendance peut être attribuée à la concentration des actifs sur des plateformes centralisées et à des mesures de sécurité potentiellement laxistes sur certaines plateformes d’échange.

L’équipe Cyvers prend L’incident de DMM Bitcoin en est un exemple. La plateforme d’échange centralisée basée au Japon a subi un piratage informatique important en mai 2024entraînant des pertes de 305 millions de dollars. Cet événement a marqué le plus grand piratage de blockchain depuis décembre 2022 et le troisième plus important de l’histoire de la cryptographie.

Le piratage a impliqué le transfert de 4 502,9 BTC (plus de 308 millions de dollars) vers plusieurs adresses, ce qui a compliqué les efforts de récupération. Au départ, la nature du transfert n’était pas claire. Cependant, DMM Bitcoin a confirmé qu’il s’agissait d’une faille de sécurité et a lancé une enquête.

Elle a également assuré aux clients que leurs dépôts restaient sécurisés. Les causes potentielles comprenaient des connexions à chaud compromises portefeuille des clés permettant des transactions non autorisées, des attaquants incitant les utilisateurs à signer des transactions malveillantes ou en alimentant les historiques de transactions avec des adresses similaires pour induire les utilisateurs en erreur.

Pendant ce temps, dans les secteurs DeFi, l’équipe Cyvers a signalé que échanges décentralisés (DEX) a été témoin d’incidents importants, toutefois moins graves que ceux qui ont touché leurs homologues centralisés.

Les protocoles de prêt ont connu des impacts modérés, avec des impacts notables incidents impliquant Sonne Finance et UwU Lending. L’équipe Cyvers a examiné l’exploitation de Sonne Finance, en la prenant comme étude de cas.

« L’exploitation de 20 millions de dollars de Sonne Finance impliquait un système complexe oracle « Une tactique de manipulation. Les attaquants ont exploité une vulnérabilité dans le mécanisme de flux de prix du protocole, gonflant momentanément la valeur d’un jeton moins connu. Cela leur a permis d’emprunter contre la garantie gonflée et de vider les réserves de liquidités du protocole avant que le prix ne puisse être corrigé », ont-ils expliqué.

Les ponts sont devenus une cible croissante, avec des incidents comme XBridge. Les portefeuilles et les dépositaires ont également subi des pertes importantes, avec des pertes notables des incidents comme Coinstats.

De l’empoisonnement d’adresses à la manipulation d’oracles : les tendances du deuxième trimestre

L’augmentation du nombre de tentatives d’empoisonnement d’adresses démontre la ruse croissante des pirates et souligne la nécessité de renforcer les mesures de sécurité. L’empoisonnement d’adresses peut entraîner des pertes financières importantes en raison de la confiance des utilisateurs dans les adresses familières.

Montant des pertes dues à une violation du contrôle d’accès par rapport aux exploitations de contrats. Source : Cyvers

Montant des pertes dues à une violation du contrôle d’accès par rapport aux exploitations de contrats. Source : Cyvers

Parmi les autres tendances notables au deuxième trimestre 2024, citons les attaques de prêts flash exploitant les vulnérabilités temporaires des protocoles de liquidité, les attaques de manipulation d’oracle exploitant les flux de prix pour des opportunités d’arbitrage et les attaques inter-chaînes exploitant les faiblesses des protocoles de pont pour siphonner des fonds à travers les chaînes.

Le trimestre a également été marqué par une sophistication croissante des techniques de blanchiment d’argent post-attaque. Les attaquants ont de plus en plus utilisé des ponts inter-chaînes pour déplacer les fonds volés sur plusieurs blockchains, ce qui a compliqué les efforts de suivi.

Nouvelle offre de protocoles DeFi Des fonctionnalités améliorant la confidentialité ont été exploitées à des fins de blanchiment d’argent Les algorithmes d’IA sont utilisés pour automatiser et optimiser le mouvement des fonds volés, rendant les méthodes de suivi traditionnelles moins efficaces. On a assisté à une utilisation accrue de pièces de confidentialité, de mélangeurs décentralisés et de méthodes sophistiquées pour masquer les traces de transactions, notamment les échanges inter-chaînes et les solutions de couche 2.

La réponse rapide atténue les pertes de DeFi au deuxième trimestre 2024

Les stratégies efficaces de réponse aux incidents observées au deuxième trimestre 2024 comprenaient une action rapide pour geler les contrats vulnérables et minimiser les pertes dans plusieurs incidents DeFi. Cyvers a noté que certains protocoles DeFi ont mis en œuvre avec succès des équipes de sécurité décentralisées capables de réagir rapidement aux menaces et de les atténuer.

Par exemple, une meilleure coordination entre les bourses, les sociétés d’analyse de blockchain et les forces de l’ordre a permis de récupérer 22 millions de dollars. le hack des Gala Games. De plus, Pump.fun, la plateforme de création de pièces de monnaie mème sur Solana, démontré La réponse rapide de la société après la faille de sécurité a consisté notamment à suspendre immédiatement le contrat, à interagir avec le pirate via des messages en chaîne et à lui proposer une prime. Grâce à leurs mesures proactives, 80 % des fonds volés ont été restitués dans les 24 heures.

Cyvers prédit une augmentation des attaques sur les solutions de couche 2 et les plateformes de jeu

Sur la base des tendances du deuxième trimestre, l’équipe Cyvers prévoit que plusieurs menaces émergeront à l’avenir. Il s’agit notamment d’une augmentation continue des exploits de contrats sophistiqués, de l’intégration de l’IA dans les vecteurs d’attaque, d’un risque accru pour les normes cryptographiques actuelles à mesure que l’informatique quantique progresse, d’un ciblage accru des solutions de couche 2 avec leur adoption croissante et du potentiel d’attaques exploitant les vulnérabilités sur plusieurs chaînes. En outre, il existe une possibilité de nouvelles attaques sur les plateformes de jeu et les NFT.

À mesure que l’écosystème devient de plus en plus interconnecté, des audits de sécurité doivent être envisagés pour améliorer les interactions entre les chaînes. Il est essentiel de tirer parti de l’IA pour détecter et répondre aux menaces en temps réel, de favoriser un meilleur partage des informations et des mécanismes de défense collaboratifs dans l’ensemble du secteur et d’adopter des protocoles de sécurité multicouches.

En savoir plus: Les 5 principales failles de sécurité des crypto-monnaies et comment les éviter

Le comportement des utilisateurs continue de jouer un rôle crucial dans les incidents de sécurité. Le phishing et l’ingénierie sociale restent des facteurs importants dans les failles de sécurité. Les mots de passe faibles et la réutilisation de mots de passe continuent d’être exploités dans les attaques. Les utilisateurs qui accordent des autorisations inutiles aux contrats intelligents restent une vulnérabilité importante.

Des campagnes régulières de sensibilisation à la sécurité, des bonnes pratiques en matière de gestion des clés privées et d’authentification multifacteur, des portefeuilles et des DApps mettant en œuvre des avertissements en temps réel pour les transactions suspectes, ainsi que des programmes d’éducation entre pairs au sein des communautés cryptographiques ont efficacement sensibilisé à la sécurité.

Clause de non-responsabilité

Suivant le Projet de confiance Cet article présente les opinions et les points de vue d’experts ou d’individus du secteur. BeInCrypto s’engage à fournir des rapports transparents, mais les opinions exprimées dans cet article ne reflètent pas nécessairement celles de BeInCrypto ou de son personnel. Les lecteurs doivent vérifier les informations de manière indépendante et consulter un professionnel avant de prendre des décisions basées sur ce contenu. Veuillez noter que notre Termes et conditions, politique de confidentialitéet Avis de non-responsabilité ont été mis à jour.

DeFi

Is Zypto Wallet a Reliable Choice for DeFi Users?

Zypto wallet is a newcomer in the crypto landscape and has already made waves for its exclusive benefits and security features.

In this article, we will take a look at the Zypto crypto wallet and how it can help users securely manage their digital assets, interact with Web3 applications, and explore the world of Challenge.

What is Zypto Wallet?

Zypto App is a newly launched versatile crypto wallet that supports a wide range of coins and tokens, along with seamless access to Web3 applications, token exchanges, virtual crypto cards, a gift card marketplace, and a payment gateway.

What are the pros and cons of Zypto Wallet?

Benefits

- User-friendly: Zypto’s user interface is very intuitive with a simple setup process.

- Multi-Chain DEX Swaps: Zypto facilitates trading between thousands of cryptocurrencies, thanks to its versatile multi-chain token swap feature.

- Built-in dApp Browser: You can access Web3 applications directly in your wallet using the in-app dApp browser.

- Live Customer Support: The wallet has an in-app live customer support team that responds quickly to all your queries.

- Rewards Program: Zypto has a loyalty program that allows you to earn rewards, improving the overall user experience.

- Virtual crypto cards: The wallet makes it easy and reliable to use digital currencies for everyday transactions through its range of virtual cryptocurrency cards.

The inconvenients

- Limited analysis tools: Zypto offers advanced charting features and limited technical analysis tools that might not appeal to experienced cryptocurrency traders.

What DeFi products and services does Zypto Wallet offer?

Zypto allows you to securely manage a wide range of cryptocurrencies across multiple blockchains, acting as a user-friendly entry point into the Web3 ecosystem.

Multi-Chain Wallet

As a multi-chain wallet, Zypto supports hundreds of thousands of digital assets across different blockchains. Zypto is also committed to adding support for more chains in the coming months, expanding its universe of explorable assets.

Multi-Chain Exchange Functionality

Instead of the tedious process of selling one token on one exchange and buying another of the same type hosted on a different blockchain, Zypto offers a cross-chain swap feature.

DApp Browser

Another easy-to-use feature is the in-app dApp browser. Simply bring up the browser from the small globe icon at the bottom of your screen and it will first take you to the Zypto homepage.

The browser provides all the features under one application so you don’t miss anything that warrants opening a separate browser.

Zypto DeFi Wallet Review

User experience

Zypto’s ease of use is one of its main advantages. Once the app is downloaded, you can view your wallet from the home screen. Other buttons at the bottom of your screen will take you to prepaid virtual cards, an Explore Zypto page, where you can send, receive, exchange, buy and sell tokens, or access the dApp browser and your contact list.

Zypto requires KYC information before processing cards, as it is part of regulatory compliance. Contacts are another benefit: instead of tediously copying and pasting long addresses, simply save them under a contact name.

How to set up your Zypto wallet?

To start using Zypto, simply download the app. Once installed, you’re ready to go.

You can create a new wallet by pressing the Create Wallet button or import an existing wallet by writing (or pasting) your passphrase to verify your identity. You can also import it in read-only mode, in which case you only need the wallet name and address.

Conclusion: The Verdict

Zypto is relatively new in the DeFi space, but it’s already gaining popularity among different types of users. Those who prefer everything neatly organized in one place will find the app appealing, as will those who prefer its rich features and integration with fiat payment methods over on- and off-ramp cryptocurrencies.

DeFi

Switchboard Revolutionizes DeFi with New Oracle Aggregator

Switchboard, a leading oracle network known for its permissionless and fully customizable features, has launched a revolutionary oracle aggregator. This new tool enables seamless integration of data across multiple oracle networks, including household names like Chainlink and Pyth Network. In doing so, it provides users with access to a wide range of data sources, improving the versatility and reliability of decentralized finance (DeFi) applications.

Addressing security and cost challenges in DeFi

The Oracle Aggregator is designed to address significant security and cost challenges in the DeFi sector. In 2023, the Web3 industry saw losses exceeding $500 million due to price manipulation attacks, a notable increase from $403.2 million in 2022. These attacks accounted for 33% of the total value lost due to hacks. By expanding the diversity and volume of data sources, Switchboard aims to strengthen the resilience of data streams against such malicious activities, thereby improving the overall security of DeFi platforms.

Empowering developers with customizable data streams

Switchboard’s new Oracle Aggregator allows developers to design custom data feeds that draw from a wide range of sources, both within and outside of the Switchboard platform. This flexibility allows developers to create tailored feeds that meet their specific needs, moving away from rigid templates. The platform’s permissionless nature and lack of gatekeepers ensure developers have complete control over the data feeds they create.

Switchboard CEO Chris Hermida noted that the company’s philosophy has always been to empower developers rather than constrain them. By launching Oracle Aggregator, Switchboard allows developers to use data from a variety of sources, including Pyth and Chainlink, enabling innovation and customization of their projects. Hermida noted that this new capability allows developers to break away from traditional models and take a more personalized approach to data integration.

Plug-and-Play approach for enhanced security

Switchboard’s Oracle Aggregator offers a plug-and-play approach that allows users to leverage multiple Oracle networks, enhancing data security and reliability. By aggregating data from multiple sources, developers can improve the scalability and redundancy of their data feeds, setting a new industry standard as the first generalized Oracle aggregator. This scalability ensures that projects can mitigate risks associated with data manipulation and other vulnerabilities.

One of the most notable features of Oracle Aggregator is its customizable nature. Developers can selectively choose trusted data sources, eliminating those that do not meet their standards. This level of control is crucial for projects that aim to protect their operations from potential threats.

Innovative use of secure execution environments

Switchboard uses Trusted Execution Environments (TEEs) to ensure that data aggregation occurs entirely off-chain. This innovative approach minimizes gas costs associated with on-chain operations while preserving data integrity. Aggregated data is then shared with users in a single on-chain transaction, simplifying the process and reducing operational expenses.

Mitch Gildenberg, Switchboard’s CTO, highlighted the platform’s developer-centric design. He noted that the platform is designed to put developers in control, allowing them to fine-tune each data flow to their specific needs. This approach reflects Switchboard’s commitment to understanding and meeting developer needs.

Expansion and impact on the industry

Since its launch in 2021, Switchboard has seen significant growth, amassing over 180,000 users and achieving a total valuation of $1.6 billion. The company’s commitment to user autonomy and inclusion has been a driving force behind its rapid expansion in the Web3 ecosystem. Earlier this year, Switchboard raised $7.5 million in a Series A funding round co-led by Tribe Capital and RockawayX, with additional support from leading investors including the Solana Foundation, Aptos Labs, Mysten Labs, Subzero Ventures, and Starkware.

Conclusion

As the DeFi industry continues to evolve, tools like Switchboard’s Oracle Aggregator will play a crucial role in building robust and secure decentralized applications. By giving developers the ability to integrate and customize data feeds from multiple sources, Switchboard is setting new industry standards, driving innovation, and improving the overall security of the Web3 ecosystem.

DeFi

Bitcoin is the solution to inevitable hyperfinancialization

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial team.

If there is one thing that is becoming clear, it is that hyperfinancialization is inevitable, and our best chance of achieving it successfully is through Bitcoin (Bitcoin). This decentralized cryptocurrency, known for its fixed supply and robust security, offers a unique solution to the coming problem of wealth inequality and concentrated power. By embracing Bitcoin, we can create a more transparent and resilient financial future, or we risk losing our financial sovereignty to a handful of corporations.

The hyper-financialization of the world has already begun, with the financial sector becoming a relatively larger part of the economy, in terms of size and importance. Financial structures are also expanding rapidly in other sectors.

For example, in 2023, Americans spent more than $100 billion on state-run lotteries, according to According to The Economist, the poorest citizens spent huge amounts on tickets. In addition, the online sports betting market, valued at more than $100 billion, is projected to generate nearly $46 billion in revenue this year, with a user penetration rate of 3.9%.

Moreover, Robin HoodRobinhood, a commission-free investment platform popular with retail investors, saw its funded customers climb to 23.9 million and its assets under custody soar to $129.6 billion, another prime example of the hyper-financialization trend. Robinhood began to gain traction during the COVID-19 pandemic in 2020, and the hyper-financialization trend was exacerbated. For people stuck at home, the online world became their primary means of entertainment and social interaction.

Governments then injected billions of dollars into the market, encouraging people to bet their money on the markets. The subsequent surge in inflation and the weakness of the global economy further intensified this trend, with people having to bear the burden of survival.

This has led to an increased proliferation of financial structures in different spheres of life, meaning that both manufacturers and consumers are taking this route.

As we can see, cryptocurrency has grown from less than $150 billion in March 2020 to $2.7 trillion today. This explosive growth not only accelerates the trend towards the hyperfinancialization of finance with yield farming, resttaking, points, rewards and meme coins, but also that of art via NFTs, social dynamics via social tokens and platforms like Friendtech, game with play-to-win conceptsand physical assets through tokenization.

There are also prediction markets that allow people to bet on all sorts of events. These range from the outcome of the 2024 US presidential election to whether Bitcoin will hit $100,000 by the end of the year, whether Drake’s verse in “Wah Gwan Delilah” is an AI, what the opening weekend box office of “Bad Boys: Ride or Die” will be, or whether the Fed will raise rates this year.

This growing trend towards hyper-financialization is detrimental to society because it widens already large wealth gaps by increasing wealth concentration and contributing to economic inequality. Not to mention that it will lead to even larger asset bubbles, a focus on the short term at the expense of the long term, and an increased interest in speculative investments.

Here, cryptography can help find a better way to address hyperfinancialization. After all, the wealth is in the middlemen, and using blockchain technology removes this third party from the equation, bringing reliability, traceability, and immutability to the market. Blockchain actually allows hyperfinancialization to be fair and transparent.

Before the advent of cryptocurrencies, not everyone was allowed to participate in markets. But through disintermediation and permissionlessness, cryptocurrencies have made markets more efficient and accessible. Not to mention, everyone gains full control over their data, mitigating the risk of data manipulation and privacy violations.

This is where Bitcoin offers the perfect solution. This decentralized peer-to-peer network enables financial inclusion and censorship resistance, which is critically important in today’s world where organizations and governments are encroaching on people’s rights. This network has a decade-and-a-half-old history behind it, providing a robust and secure platform for people to achieve financial sovereignty.

This trillion-dollar asset class also serves as a hedge against inflation, allowing holders to preserve their wealth over time. Unlike fiat currencies, which are devalued by politicians, Bitcoin’s fixed supply and decentralization protect it from such pressures, making it the perfect asset to own in a world where everyone is competing to extract value.

The largest crypto network is now also seeing experimentation, as developers and investors use it as a foundation to build a truly decentralized future of finance and value.

For so long, Bitcoin has been a low-activity blockchain, with its key role being to store value. While Bitcoin has played a passive role in the blockchain world for all these years, it has finally changed with Taproot Upgrade which brought NFTs into the Bitcoin world. Then there was a growing interest in tokenization, also from institutions like Blackrock.

This drive to expand Bitcoin’s utility has sparked a wave of innovation, and the day is not far when BTC could dethrone Ethereum as the go-to blockchain for decentralized finance. Several aspects, including Bitcoin’s robust security framework, widespread acceptance, and institutional interest, position Bitcoin at the forefront of defi innovation.

So, with these developments, Bitcoin is now evolving to begin its new era of utility and innovation after realizing its original vision of being a peer-to-peer electronic currency system.

As everything becomes a financial asset and tradable, attention, which is a scarce resource, will become even more crucial. Bitcoin has already cemented its position in the attention economy, and the newfound interest in regulatory complaints and widespread adoption of BTC to boost productivity will allow it to lead the future of digital economies. This portends a world where crypto leads the charge towards hyperfinancialization, with BTC in the driver’s seat.

So, to conclude, the resilient Bitcoin network that has spectacularly survived the test of time may have started as a means to facilitate the seamless flow of monetary value, but today, it has become a foundation of hope not only to protect against a future that is going to be super fixated on the financial aspect, but also to take advantage of it to create wealth and prosper.

Jeroen Develter

Jeroen Develter is the Chief Operating Officer at Persistence Labs and a seasoned professional in financial and tech startup environments. With a decade of international consulting, management, entrepreneurship and leadership experience, Jeroen excels at analyzing complex business cases, establishing streamlined operations and creating scalable processes. With Persistence, Jeroen oversees all product and engineering efforts and is deeply passionate about improving the adoption of Bitcoin defi, or BTCfi, and using intents to develop scalable, fast, secure and user-friendly solutions. His work at Persistence Labs addresses the significant interoperability challenges between Bitcoin L2s. In addition, Jeroen is also a co-host of the Stacked Podcast, a platform to gain knowledge about Bitcoin and cryptography from prominent Bitcoin creators.

DeFi

Haust Network Partners with Gateway to Connect to AggLayer

Dubai, United Arab Emirates, August 1, 2024, Chainwire

Consumer adoption of cryptocurrencies is a snowball that is accelerating by the day. More and more people around the world are clamoring for access to DeFi. However, the user interface and user experience of cryptocurrencies still lag behind their fundamental utility, and users lack the simple and secure access they need to truly on-chain products.

Haust Network is a network and suite of products focused on changing this paradigm and bringing DeFi to the masses. To achieve this goal, Haust Network has announced its far-reaching partnership with bridgeseasoned veterans in rapidly delivering revolutionary blockchain utilities for projects. The Gateway team empowers blockchain developers to build DAOs, NFT platforms, payment services, and more. They drive adoption of crypto primitives for individuals and institutions around the world by helping everyone build their on-chain presence.

Gateway specializes in connecting sovereign blockchains to the Aggregation Layer (AggLayer). The AggLayer is a single unified contract that powers the Ethereum bridge of many disparate blockchains, allowing them all to connect to a single unified liquidity pool. The AggLayer abstracts away the complexities of cross-chain DeFi, making tedious multi-chain transactions as easy for the end user as a single click. It’s all about creating access to DeFi, and with Polygon’s technology and the help of Gateways, Haust is doing just that.

As part of their partnership, Gateway will build an advanced zkEVM blockchain for Haust Network, leveraging its extensive experience to deploy ultra-fast sovereign applications with unmatched security, and enabling Haust Network to deliver its products to its audience.

The recently announced launch of the Haust Wallet is a Telegram mini-app that provides users with access to DeFi directly through the Telegram interface. Users who deposit funds into the wallet will have access to all standard send/receive services and generate an automatic yield on their funds. The yield is generated by Haust Network’s interconnected network of smart contracts, Haustoria, which provides automated and passive DeFi yielding.

As part of this partnership, the Haust Network development team will work closely with Gateway developers to launch Haust Network. Gateway is an implementation provider for Polygon CDK and zkEVM technology, which the Haust wallet will leverage to deliver advanced DeFi tools directly to the wallet users’ fingertips. Haust’s partnership with Gateway comes shortly after the announcement of a high-profile alliance with the Polygon community. Together, the three will work to build Haust Network and connect its products to the AggLayer.

About Haust Network

Haust Network is an application-based absolute liquidity network and will be built to be compatible with the Ethereum Virtual Machine (EVM). Haust aims to provide native yield to all users’ assets. In Telegram’s Haust Wallet, users can spend and collect their cryptocurrencies in one easy place, at the same time. Haust operates its network of self-balancing smart contracts that interact across multiple blockchains and then efficiently funnel what has been generated to Haust users.

About Gateway

bridge is a leading white-label blockchain provider that offers no-code protocol deployment. Users can launch custom blockchains in just ten minutes. They are an implementation provider for Polygon CDK and have already helped projects like Wirex, Gnosis Pay, and PalmNFT bring new utility to the crypto landscape.

About Polygon Labs

Polygon Laboratories Polygon Labs is a software development company building and developing a network of aggregated blockchains via the AggLayer, secured by Ethereum. As a public infrastructure, the AggLayer will aggregate the user bases and liquidity of any connected chain, and leverage Ethereum as the settlement layer. Polygon Labs has also contributed to the core development of several widely adopted scaling protocols and tools for launching blockchains, including Polygon PoS, Polygon zkEVM, and Polygon Miden, which is currently under development, as well as the Polygon CDK.

Contact

Lana Kovalski

haustnetwork@gmail.com

-

DeFi1 year ago

DeFi1 year agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News1 year ago

News1 year agoLatest Business News Live Updates Today, July 11, 2024

-

DeFi1 year ago

DeFi1 year agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Fintech1 year ago

Fintech1 year agoFinTech LIVE New York: Mastercard and the Power of Partnership

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

Fintech1 year ago

Fintech1 year ago121 Top Fintech Companies & Startups To Know In 2024

-

ETFs1 year ago

ETFs1 year agoGold ETFs see first outing after March 2023 at ₹396 cr on profit booking

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

Fintech1 year ago

Fintech1 year agoFintech unicorn Zeta launches credit as a UPI-linked service for banks

-

ETFs1 year ago

ETFs1 year agoLargest US Bank Invests in Spot BTC ETFs While Dimon Remains a Bitcoin Hater ⋆ ZyCrypto

-

News1 year ago

News1 year agoSalesforce Q1 2025 Earnings Report (CRM)