News

Financial News | Volkswagen Group

Volkswagen shareholders formally approve actions of Board of Management and Supervisory Board and adopt resolution on dividend for 2023

At the Annual General Meeting of Volkswagen AG, the shareholders followed the proposal of the Board of Management and Supervisory Board and resolved by a majority of 99,99 % to pay an increased dividend of EUR 9.00 per ordinary share and EUR 9.06 per preference share for the 2023 financial year. This corresponds to a payout ratio of 28 per cent and an increase of EUR 0.30 per share. Volkswagen AG is distributing a total of EUR 4.5 billion to its shareholders for the 2023 financial year.

From Europe, for Europe: Volkswagen Group launches project for all-electric entry-level mobility

The Board of Management of the Volkswagen Group has decided to make all-electric entry-level mobility more widespread. The Brand Group Core will bring affordable electric vehicles from Europe, for Europe, into the market. The world premiere is scheduled for 2027. Volkswagen has been working for some time to offer compact, particularly inexpensive electric vehicles in the price range of around 20,000 euros. In this way, the Group’s volume brands are fulfilling their promise to create mobility for all and continue to facilitate the entry into e-mobility. With its brand diversity, the Volkswagen Group also assumes a social responsibility for affordable, sustainable mobility.

New models, clear plan: Audi Board of Management optimistic about the future after a challenging first quarter

2024 will be a demanding year for the Audi Group. The challenging market environment and supply bottlenecks, especially for V6 and V8 engines, had a particularly negative impact on operating profit in the first quarter of the year. The company also has to manage numerous product ramp-ups. Revenue reached €13.7 billion in the first quarter of the year, while operating profit amounted to €466 million. The operating margin was 3.4 percent. In the first three months of the year, the Brand Group Progressive delivered 402,048 automobiles to customers – a decline of 4.7 percent. The demand for fully electric models, however, increased by 3 percent. Audi registered a significant increase of 13.7 percent in China, with 156,082 models delivered.

Audi Q6 SUV e-tron quattro: Electric power consumption (combined): 19.6–17.0 kWh/100 km; CO2 emissions (combined): 0 g/km; CO2-class: A

Audi Q6 SUV e-tron quattro: Electric power consumption (combined): 19.6–17.0 kWh/100 km; CO2 emissions (combined): 0 g/km; CO2-class: A

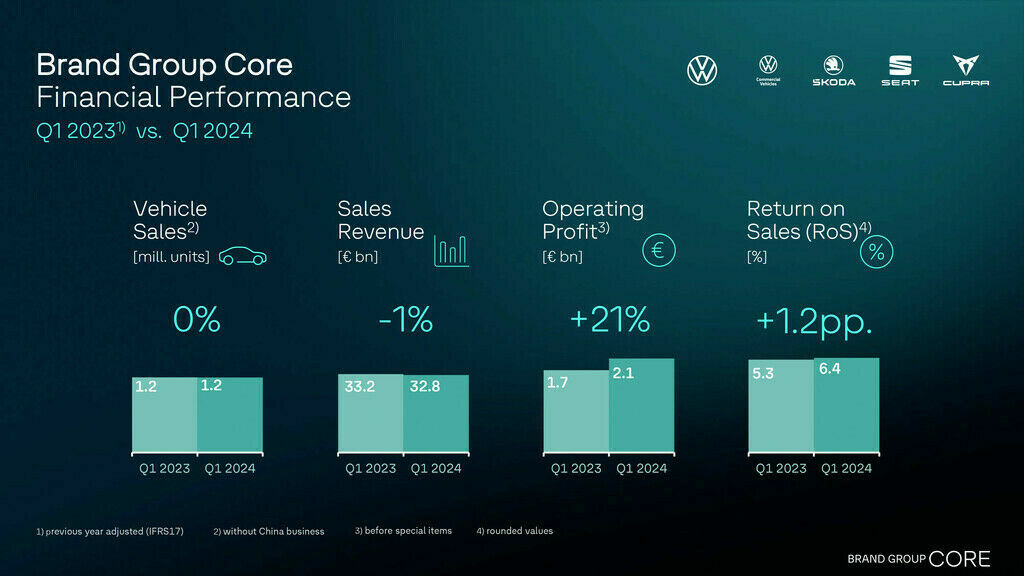

Brand Group Core increases operating profit in Q1 2024 despite challenging market environment

The Brand Group Core delivered robust financial results in the first quarter of 2024. With stable vehicle sales and slightly lower sales revenue, the Brand Group Core reported a significant year-on-year increase in operating profit and operating return. At 6.4%, operating return was well within the target corridor of 6-7% for 2024. All brands contributed to this achievement, reporting higher returns on the basis of focused cost management as well as increased implementation of synergy and efficiency measures within the Brand Group. The financial performance in the first quarter felt the impact of offsetting effects – these included, for example, the abrupt termination of government incentives for electric cars in the German market and the related discount measures at the beginning of the year. Furthermore, there was high depreciation attributable to investments in product campaigns and the related ramp-up of electric products.

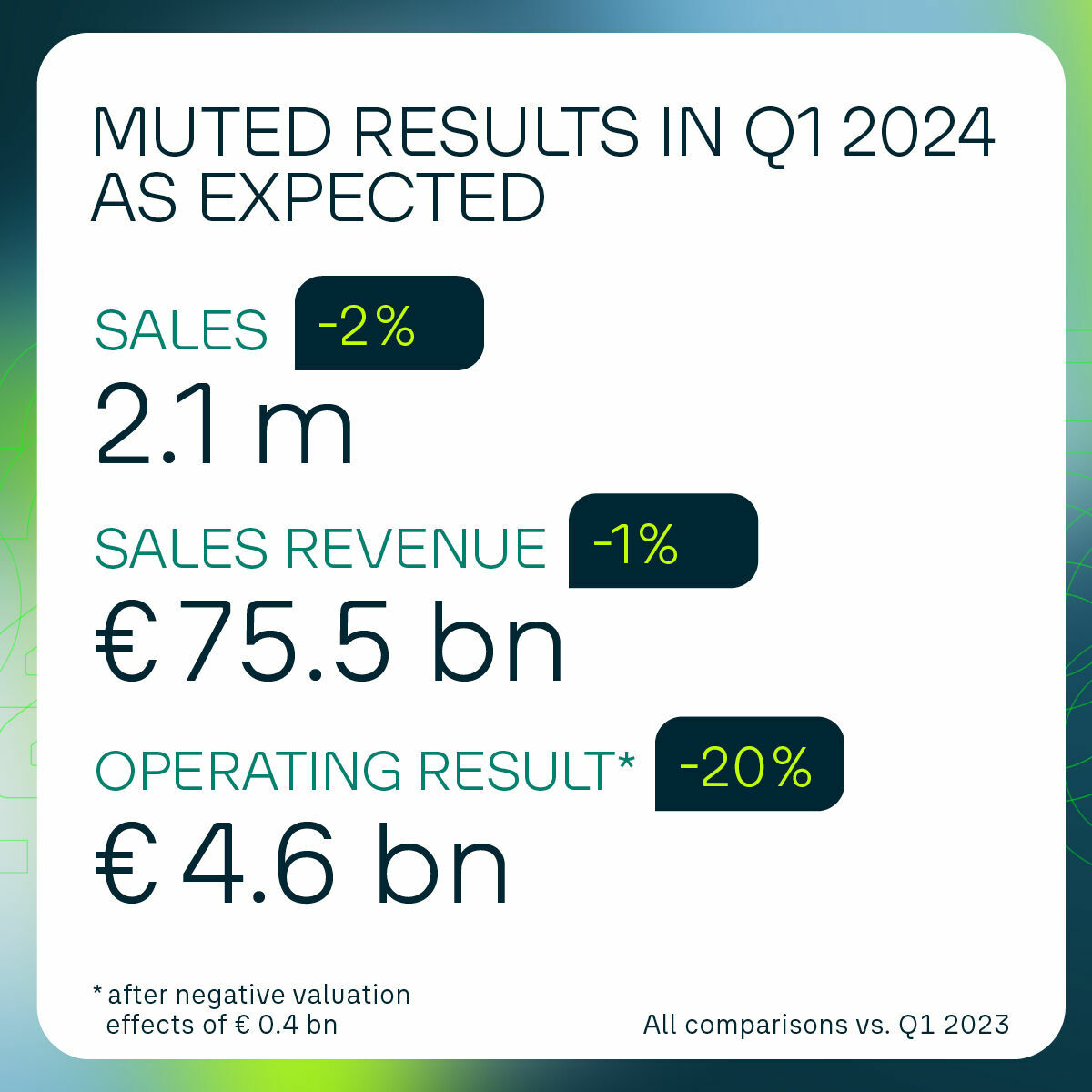

Volkswagen Group: Q1 2024 muted as expected – Outlook confirmed

Porsche AG kicks off a year of product launches with determination

Porsche AG has got off to a vigorous and forward-looking start to the challenging 2024 financial year. In this year of product launches, the sports car manufacturer is renewing four out of its six model lines. The first quarter was marked by the ramp-ups of the third model generation of the Panamera and the new Taycan. In addition, large-scale investments have been made in digitalization and research and development. Accordingly, the Porsche Group recorded an expected decline in sales and earnings in the first three months. At the end of the quarter, Group sales revenue amounted to 9.01 billion euros (previous year: 10.10 billion euros). Group operating profit was 1.28 billion euros (previous year: 1.84 billion euros). Group sales revenue came in at 14.2 per cent (previous year: 18.2 per cent).

Taycan Turbo GT with Weissach package (WLTP): Electrical consumption combined: 21.3 – 20.6 kWh/100 km; CO₂ emissions combined: 0 g/km; CO₂ class: A; Status 04/2024

Taycan Turbo GT with Weissach package (WLTP): Electrical consumption combined: 21.3 – 20.6 kWh/100 km; CO₂ emissions combined: 0 g/km; CO₂ class: A; Status 04/2024

TRATON GROUP reports successful start to 2024 with higher sales revenue, earnings, and profitability

The TRATON GROUP reported a successful start to 2024 and increased its sales revenue, adjusted operating result, and adjusted operating return on sales in the first quarter despite a slight decrease in unit sales. The TRATON GROUP brands sold a total of 81,100 (3M 2023: 84,600) vehicles between January and March, a slight year-on-year decline of 4%. At the same time, sales revenue grew 5% to €11.8 billion (3M 2023: €11.2 billion) thanks to a favorable product and market mix and improved unit price realization. Accounting for 19% (3M 2023: 20%) of total sales revenue, the vehicle services business made a considerable contribution to business performance. At 66,400 (3M 2023: 68,500) vehicles, the Company’s incoming orders in the first quarter of the year were solid and thus only slightly down by 3% year-on-year. The book-to-bill ratio, or the ratio of incoming orders to unit sales, was 0.8 in the first three months. This meant that unit sales were higher than incoming orders, allowing order backlog to continue to return to normal.

At €1,106 million (3M 2023: €935 million), adjusted operating result was up significantly on the prior-year period. In light of the 5% increase in sales revenue, adjusted operating return on sales rose by 1 percentage point in the first quarter of 2024 to 9.4%.

Volkswagen Group takes the offensive in China by strengthening tech capabilities and reducing costs

Volkswagen launches the next phase of its transformation in China. At its China Capital Markets Day in Beijing, Volkswagen Group presented its strategy update for the Chinese market. The focus is on its target to strengthen tech capabilities and reduce costs in the strongly growing market. The Group plans to achieve cost parity with local competition in the compact car segment by 2026 and gain further momentum through a re-aligned strategy and an efficiency program that was launched already. In addition, the company underlined its commitment to its “in China, for China” strategy: It presented measures to cater even better to the needs of Chinese customers, accelerate model developments and time-to-market as well as significantly reduce costs. In addition, the aim is to better harness the innovative power of the market and increase local value creation through more in-house development capabilities and strong local partnerships. As a result, the Group aims to strengthen its position as the #1 international OEM in the Chinese market and has set ambitious targets until 2030: Approximately 4 million vehicles sold and growth in proportionate operating result to around EUR 3.0 billion, including the fully consolidated Anhui joint venture.

Volkswagen Group delivers 3 percent more vehicles in the first quarter

The Volkswagen Group increased its deliveries in the first quarter of 2024 by 3 percent to 2.10 million vehicles. The main growth drivers were China (+8 percent), South America (+14 percent) and North America (+5 percent). Vehicles with combustion engines increased by 4 percent to 1.97 million units, overcompensating the slight decline of 3 percent to 136,400 all-electric vehicles (BEV). In this segment, strong growth in China (+91 percent) did not fully offset the decline in Europe (-24 percent). However, incoming orders for BEVs in Western Europe developed positively from January to March. More than twice as many all-electric models were ordered as in the same period last year (+154 percent), so that the BEV order bank currently stands at around 160,000 vehicles.

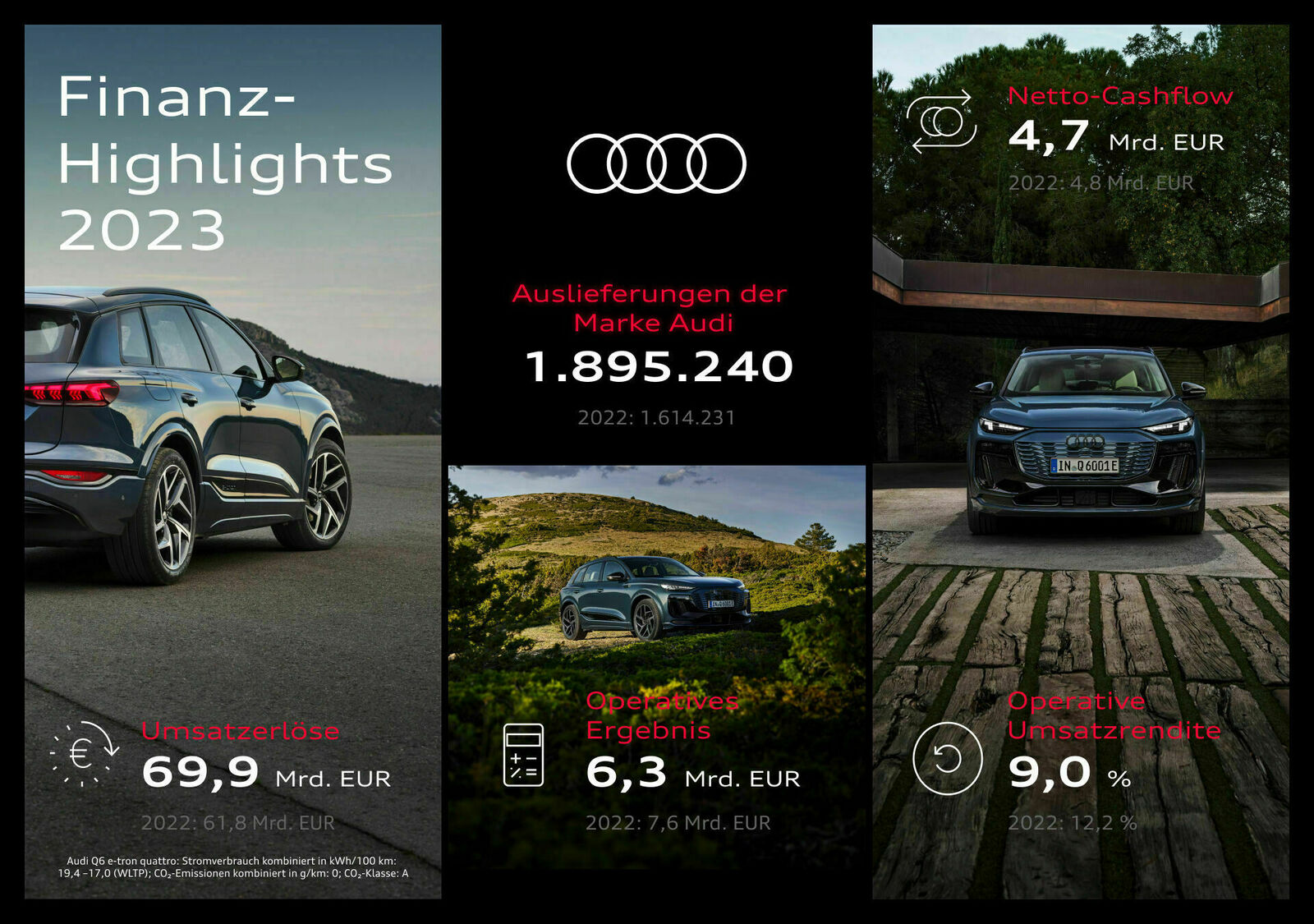

After a solid fiscal year 2023: Audi strengthens and expands its product portfolio

The Audi Group has achieved a solid result in the 2023 fiscal year under challenging economic conditions. Revenue rose by 13.1 percent to €69.9 billion, the operating profit was €6.3 billion, and the operating margin was 9.0 percent. Net cash flow was nearly on par with the previous year at €4.7 billion. With numerous new models, Audi will significantly strengthen and expand its product portfolio in the coming years: The world premiere of the fully electric Audi Q6 e-tron, the first model on the new Premium Platform Electric (PPE), heralds a series of product launches. More than 20 new models are planned for 2024 and 2025.

Audi Q6 e-tron quattro: Combined power consumption in kWh/100 km: 19.4 -17.0 (WLTP); CO2 emissions combined in g/km: 0; CO2-class A Consumption and emission values are only available according to WLTP and not according to NEDC for these vehicles.

Audi Q6 e-tron quattro: Combined power consumption in kWh/100 km: 19.4 -17.0 (WLTP); CO2 emissions combined in g/km: 0; CO2-class A Consumption and emission values are only available according to WLTP and not according to NEDC for these vehicles.

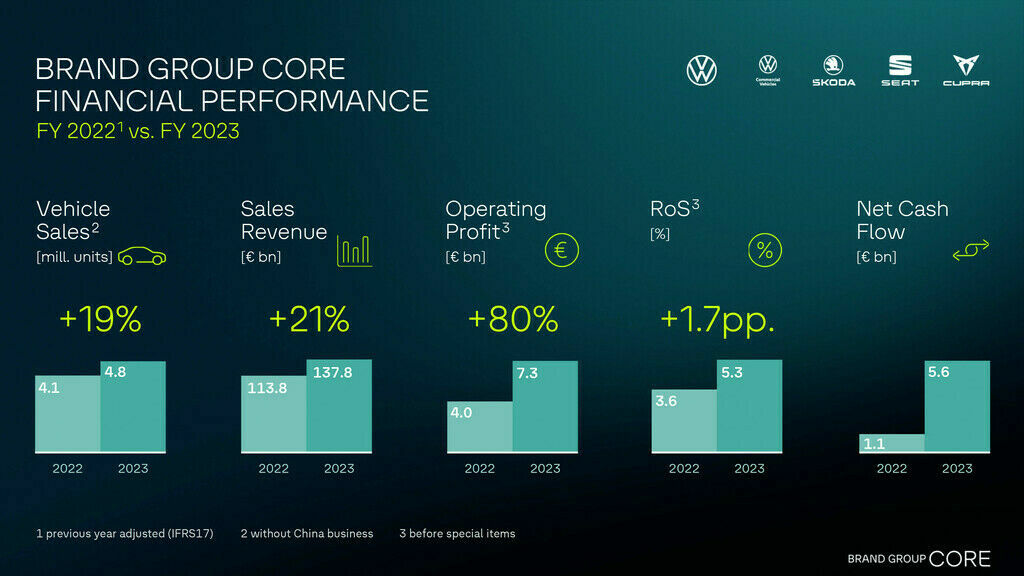

Brand Group Core improves result and return in 2023 – closer cooperation between the volume brands is gaining traction

The Brand Group Core delivered robust financial results in 2023. Higher volume and price effects, improved availability of parts and lower fixed costs had a positive effect, while higher product costs and the deconsolidation of Volkswagen Group Rus had a negative impact on the result. The global market and competitive environment remains challenging. The Brand Group Core is working on further stabilizing its performance with a view to improving its resilience against external factors, in particular given the slower development of the e-mobility market in Europe.

Volkswagen Group delivers robust 2023 results – Performance programs and record number of new product launches stabilize future development

Volkswagen Group achieved robust financial results in a challenging environment in 2023. Thanks to progress in electrification and a flexible product strategy, the Group successfully is able to meet customers’ needs worldwide. At the same time, 2023 was a year of restructuring for Volkswagen Group. In many areas of the TOP-10 program, the Group has made progress faster than originally planned. With more than 30 new products, 2024 will be the year of world premieres, with highlights including the high-performance all-electric vehicles based on the new PPE premium platform. Volkswagen Group is therefore confident about the current year and an accelerated ramp-up from 2025 onwards. The overarching Group goal remains sustainable, value-creating growth.

Porsche AG enters its biggest year of product launches in a strong position

Macan 4 (WLTP): combined power consumption: 21.1 – 17.9 kWh/100 km; combined CO₂ emissions: 0 g/km; CO₂ class: A; as of 03/2024

Macan 4 (WLTP): combined power consumption: 21.1 – 17.9 kWh/100 km; combined CO₂ emissions: 0 g/km; CO₂ class: A; as of 03/2024

Volkswagen Group achieves robust annual results for 2023, with a strong fourth quarter

Volkswagen Group achieved robust financial results in 2023. This was driven by a strong fourth quarter, with sales revenue of EUR 87 billion and an increase in operating profit of more then a quarter compared to the previous year. During the year, the Group made further progress with the implementation of its strategy and systematically pushed ahead with its restructuring. The focus was on customer-oriented products and compelling design, in addition to the strengthening of the regions, particularly China and North America. By introducing performance programs in all divisions, the Group has made notable strides towards a sustainable increase in profitability.

Volkswagen and Mahindra sign supply agreement

Volkswagen Group and Mahindra & Mahindra Ltd. (M&M) have signed the first supply agreement on components of Volkswagen´s MEB for Mahindra’s purpose-built electric platform INGLO, taking a definitive step further on their joint vision for e-mobility collaboration. The deal covers the supply of certain electric components as well as unified cells. With the agreement, Volkswagen and Mahindra are further deepening their collaboration which started with a partnering agreement and a term sheet in 2022. Both companies will continue to evaluate a potential expansion of the collaboration.

Volkswagen AG and Volkswagen Financial Services AG with further credit rating in the A-category

Volkswagen Group strengthens its Technical Development Board function in China

The Volkswagen Group is strengthening its Technical Development Board function in the China region as part of its “In China, for China” strategy. Thomas Ulbrich, former Member of the Board of Management of the Volkswagen Brand for “New Mobility”, will head up Technical Development for the Group in China from April 1, 2024. In his new capacity, Ulbrich, who has already held two management positions for the Group in China, will continue to advance the technological localization of the portfolio. He succeeds Marcus Hafkemeyer, who – with his extensive experience of China – will support the company’s transformation in a new role in the Group.

Volkswagen Group posts solid growth in deliveries in 2023 and strong increase in all-electric vehicles

The Volkswagen Group increased its deliveries in 2023 by

12 percent to 9.24 million vehicles. All regions contributed to this growth, with Europe

(+19.7 percent) and North America (+17.9 percent) being the main drivers. China, the Group’s largest single market, grew by 1.6 percent despite a challenging market environment. The Volkswagen Group expanded its market share in Europe as well as North and South America and thus also increased slightly worldwide. Almost all brands recorded growth, in some cases substantial. SEAT/CUPRA achieved the highest increase in the passenger car segment with a rise of 34.6 percent, while MAN led the way in the truck segment with an increase of 37.1 percent. At the same time, the Volkswagen Group successfully continued its transformation and delivered 771,100 fully electric vehicles. This corresponds to an increase of 34.7 percent compared to the previous year. The share of all-electric vehicles in deliveries rose to 8.3 percent compared to 6.9 percent in 2022.

PowerCo confirms results: QuantumScape’s solid-state cell passes first endurance test

The solid-state cell is considered a technology of the future and the next big step in battery development. The technology promises longer ranges, shorter charging times and maximum safety. The U.S. company QuantumScape has recently reached an important milestone, which was now confirmed by PowerCo: its solid-state cell has significantly exceeded the requirements in the A-sample test and successfully completed more than 1,000 charging cycles. For an electric car with a WLTP range of 500-600 kilometres, this corresponds to a total mileage of more than half a million kilometres. At the same time, the cell barely aged and still had 95 percent of its capacity (or discharge energy retention) at the end of the test. The tests, which ran for several months, were carried out in PowerCo’s battery laboratories in Salzgitter

Volkswagen brand’s biggest performance program on track, with earnings contribution of up to four billion euros expected for 2024

The Volkswagen brand has achieved an important milestone in the “Accelerate Forward/ Road to 6.5” global performance program, with management and employee representatives reaching agreement on key points to streamline the company, following intensive negotiations. The objective of the three-year program is to secure the Volkswagen Group’s core brand competitiveness, ensure it is future-proof and sustainable in the long term. The Volkswagen brand aims to make a positive earnings contribution totaling ten billion euros by 2026, also to offset negative effects such as inflation and higher raw material costs. The operating return on sales is expected to improve sustainably to 6.5 percent in 2026. The Volkswagen brand projects that the program will deliver positive earnings contributions of up to four billion euros as early as 2024. To achieve this, the Company concentrates on performance-enhancing and cost-saving measures in the program’s three focus areas: optimizing material and product costs, reducing fixed and manufacturing costs and increasing revenues. The Company and the employee representatives have also reached agreement on staff reduction measures to cut personnel and labor costs. These measures will apply throughout Volkswagen AG. As such, from January 2024 the Company will extend its partial retirement schemes to all employees born in 1967 (and for severely handicapped employees born in 1968), to reduce administrative staff costs in particular. The current hiring freeze and access freeze to the Tarif Plus salary group will continue until further notice.

News

Breakfast on Wall Street: The Week Ahead

The spotlight next week will shift somewhat to the Federal Reserve’s second-quarter earnings season and monetary policy. Market watchers will be treated to results from several major names, including Dow 30 components Goldman Sachs (GS), UnitedHealth (UNH), Johnson & Johnson (JNJ) and American Express (AXP), along with streaming giant Netflix (NFLX).

The Fed will still attract some attention as investors will be eager to hear from a packed lineup of central bank speakers just before the policy meeting lockout period.

In terms of the economic calendar, after fifteen days of labor market and inflation indicators, activity data will gain momentum in the form of the latest retail sales and industrial production reports.

Earnings Highlight: Monday, July 15 – Goldman Sachs (GS) and BlackRock (Black). See the full earnings calendar.

Earnings Highlight: Tuesday, July 16 – UnitedHealth (UNH), Bank of America (BAC), Progressive (PGR), Morgan Stanley (IN), PNC Financial (PNC) and JB Hunt Transport (JBHT). See the full earnings calendar.

Earnings Highlight: Wednesday, July 17 – Johnson & Johnson (JNJ), US Bancorp (USB), Morgan Children (KMI), United Airlines (UAL) and Ally Financial (ALLY). See the full earnings calendar.

Earnings Highlight: Thursday, July 18 – Netflix (NFLX), Abbott Laboratories (ABT), Black stone (BX), Domino’s pizza (ZDP) and Taiwan Semiconductor Manufacturing (TSM). See the full earnings calendar.

Earnings Highlight: Friday, July 19 – American Express (AXP), Halliburton (THANKS) and Travelers (VRT (return to recoverable value)) See the full earnings calendar.

IPO Observation: Hospital and healthcare clinic operator Ardent Health Partners (TARDT), insurance service provider Twfg (TWFG) and the biotechnology company Lirum Therapeutics (LRTX) are expected to price their IPOs and begin trading next week. The analyst quiet period ends at Rectitude (RECT) to free up analysts to publish ratings.

News

Trump shooting: Gold could hit record high, dollar and cryptocurrencies set to jump

Police cars outside the residence of Thomas Matthew Crooks, the suspected shooter at a Trump rally on Saturday, investigate the area in Pennsylvania. Following the incident, one rally attendee was killed, two rally attendees are in critical condition and Donald Trump suffered a non-fatal gunshot wound. The shooter is dead after being shot dead by the United States Secret Service. (Photo by Kyle Mazza/Anadolu via Getty Images)

Investors will initially favor traditional safe-haven assets and may lean toward trades more closely tied to former President Donald Trump’s chances of winning the White House after he survived an assassination attempt, according to market watchers.

“There will undoubtedly be some protectionist or safe-haven flows into Asia early this morning,” said Nick Twidale, chief market analyst at ATFX Global Markets. “I suspect gold could test all-time highs, we’ll see the yen being bought and the dollar, and flows into Treasuries as well.”

Early market commentary suggested Trump’s shooting at a rally in Pennsylvania on Saturday could also prompt traders to increase his likelihood of success in the November election. His support for looser fiscal policy and higher tariffs is generally seen as likely to benefit the dollar and weaken Treasuries.

An indicator of market sentiment heading into the weekend: Bitcoin surged above $60,000, likely reflecting Trump’s pro-crypto stance.

Other assets positively linked to the so-called Trump trade include stocks of energy companies, private prisons, credit card companies and health insurers.

Traders will also be closely watching market measures of expected volatility on Monday, such as those in the tariff-sensitive Chinese yuan and Mexican peso, which have begun to price in the U.S. vote.

Trump said he was shot in the right ear after a shooting at his rally. His campaign said in a statement that he was “fine” after the incident, which prompted him to rush off the stage.

“Currencies will be the first major market on Monday in Asia to react to the weekend’s shots. There’s potential for extra volatility, and getting a clear reading could be especially difficult because liquidity will be hurt by Japan’s national holiday,” said Garfield Reynolds, Asia team leader for Bloomberg Markets Live.

Strategists had already expected a volatile run-up to the election, particularly as Democrats are still agonizing over President Joe Biden’s candidacy after his poor performance in last month’s debate raised questions about his age. Investors were also grappling with the possibility that the election could end in a drawn-out dispute or political violence.

But there is little precedent for events like those in Pennsylvania. When President Ronald Reagan was shot four decades ago, the stock market plunged before closing early. The next day, March 31, 1981, the S&P 500 rose more than 1% and benchmark 10-year Treasury yields fell 9 basis points to 13.13%, according to data compiled by Bloomberg.

Bond investors should pay particular attention as the attack is likely to boost Trump’s election chances and ultimately lead to concerns about the fiscal outlook, according to Marko Papic, chief strategist at California-based BCA Research Inc.

“The bond market must at some point become aware of President Trump’s greater chances of winning the White House than any of his rivals,” Papic wrote. “And I continue to believe that as his chances increase, so too must the likelihood of a bond market revolt.”

Kyle Rodda, senior financial markets analyst at Capital.com, said he was seeing client flows into Bitcoin and gold following the shooting.

“This news marks a turning point in American policy norms,” he said. “For markets, it means safe-haven trades, but more tilted toward non-traditional safe-havens.”

News

Latest Business News Live Updates Today, July 11, 2024

Follow us for stories on Bill Gates, Elon Musk, Mukesh Ambani, Gautam Adani as we bring you everything that’s happening in the business world. Follow the latest gold and silver prices here too. Stay in the know on all things business with us.

Latest news on July 11, 2024: Airtel says its new Xstream Fiber plans bundle over 350 live TV channels (Official Photo) (Reuters) Disclaimer: This is an AI-generated live blog and has not been edited by Hindustan Times staff.

Follow all the updates here:

-

Thu, 11 Jul 2024 08:44 PM

Business News LIVE Updates: Decoding Airtel’s new Xstream Fiber packages, finding value with Live TV and OTT

- Airtel confirms to HT that the live TV proposition is being delivered using its DTH network, while the bundled streaming subscriptions are an extension of its Xstream Play platform.

-

Thu, 11 Jul 2024 03:58 PM

Business News LIVE Updates: TCS Q1 results meet estimates: Net profit up 9%, ₹10 dividend declared

- TCS’s consolidated revenue rose 5.4% to Rs 626.13 billion in the June quarter. Analysts had expected revenue of Rs 622.07 billion, as per LSEG data.

-

Thu, 11 Jul 2024 03:51 PM

Business News LIVE Updates: Indian companies falsified generic Viagra data to get approval, says US FDA: Report

- Synapse Labs Pvt. Ltd may have been used in hundreds of drugs that are still available for sale, the report said.

-

Thu, 11 Jul 2024 03:09 PM

LIVE Business News Updates: Namita Thapar’s emotional post on Emcure IPO listing: ‘Mirza Ghalib sums up my feelings’

- Emcure Pharmaceuticals was listed at ₹1,325.05, up 31.45% on the BSE and NSE on July 10.

-

Thu, 11 Jul 2024 02:39 PM

LIVE business news updates: Amazon could face investigation over treatment of UK food suppliers, watchdog says

- An Amazon spokesperson said the company has made several improvements for food suppliers since last year’s results.

-

Thu, 11 Jul 2024 01:39 PM

LIVE Business News Updates: This Bengaluru company aims to launch a ‘space habitat’ by 2027, in talks with SpaceX

- AkashaLabdhi calls itself a “home among the stars” as it says the company’s area of expertise is signal processing and continuous automation.

-

Thu, 11 Jul 2024 01:10 PM

Business News LIVE Updates: Amazon India employees on working conditions: Made to stand for hours, bathroom breaks not allowed

- A survey conducted by UNI Global Union with the Amazon India Workers Association had 1,838 participants who alleged appalling working conditions at Amazon facilities in India.

-

Thu, 11 Jul 2024 12:44 PM

LIVE Business News Updates: UK overhauls listing rules in bid to attract IPOs to London: What has changed?

- The new rules allow companies to carry out more activities without putting them to a shareholder vote, the UK’s Financial Conduct Authority said.

-

Thu, 11 Jul 2024 12:18 PM

Business News LIVE Updates: Want to send money abroad? Open foreign currency accounts at GIFT City

- Foreign currency accounts will be like a bank account in India, but instead of rupees, you hold foreign currency like US dollars.

-

Thu, 11 Jul 2024 11:30 AM

Business News LIVE Updates: First Abu Dhabi Bank denies interest in acquiring stake in Yes Bank: Report

- The report said the Yes Bank stake sale has attracted interest from Japan, including Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc.

-

Thu, 11 Jul 2024 11:04 AM

LIVE Business News Updates: TCS Share Price Surges Ahead of Q1 Results: What Brokers Say About the Stock

- TCS Share Price: The stock opened at ₹3,944.65 against its previous close of ₹3,909.90. It then rose 1.8 percent to ₹3,979.90 level.

-

Thu, 11 Jul 2024 10:22 AM

LIVE Business News Updates: Reliance Jio IPO listing likely in 2025 at $112 billion valuation: Jefferies

- Jio “could list at a valuation of $112 billion” and add “7-15 percent upside” to Reliance Industries’ share price, Jefferies said.

-

Thu, 11 Jul 2024 09:42 AM

LIVE Business News Updates: Yes Bank shares rise after Moody’s revises outlook to ‘positive’ from ‘stable’

- Global rating agency Moody’s has raised its outlook on Yes Bank to positive from “stable” despite expectations of a gradual improvement in its depositor base.

-

Thu, 11 Jul 2024 09:16 AM

Business News LIVE Updates: Sahaj Solar IPO opens today: All you need to know before subscribing to the issue

- Sahaj Solar IPO: The block issue aims to raise ₹52.56 crore through issuance of 2.92 million new shares and will close on July 15.

-

Thu, 11 Jul 2024 08:40 AM

LIVE Business News Updates: Why Analysts Believe India’s Earnings Season May Disappoint Stock Market Investors

- Investors in Indian stocks hoping for a robust earnings season to justify expensive valuations are likely to be disappointed.

-

Thu, 11 Jul 2024 08:35 AM

LIVE Business News Updates: Elon Musk Says Second Neuralink Brain Implant Will ‘Give People Superpowers’ Within a Week

- Elon Musk said Neuralink will make some changes to try to alleviate the problem of its electrode wires retracting from brain tissue.

-

Thu, 11 Jul 2024 07:59 AM

LIVE Business News Updates: Apple warns Indian iPhone users of possible Pegasus-like ‘spyware attack’

- In April this year, the Indian Computer Emergency Response Team (Cert-In) flagged several vulnerabilities in Apple’s operating system for iPhone and iPad.

-

Thu, 11 Jul 2024 07:45 AM

Business News LIVE Updates: US stock markets at record highs led by world’s biggest tech companies

- The Philadelphia Semiconductor Index rose 2.4% to a record high after Taiwan Semiconductor Manufacturing Co. reported strong quarterly revenue.

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

News / Business / Latest Business News Live Updates Today, July 11, 2024

Source

News

Jio Financial share price: Should you buy this Reliance group stock on Monday ahead of Q1 FY2024 results?

Q1 2024 Results: Jio Financial Share Price will be in focus on Monday as the Reliance Group company has a fixed board meeting on July 15, 2024 to consider and approve the company’s unaudited standalone and consolidated financial results. Trust Group company informed about the Q1 2024 Results date on Wednesday last week via an exchange filing. According to stock market experts, Jio Financial Services Limited is poised to deliver impressive Q1 results for FY25 on solid operating income. They have forecast a healthy QoQ PAT for the company in Q1 FY25.

Jio Financial Services News

Speaking on the Jio Financial Services Q1 2024 results, Manish Chowdhury, Head of Research, StoxBox, said, “We believe Jio Financial Services is poised to deliver impressive results in Q1FY25 aided by its operating income, which is likely to show robust growth driven by strong investment income, which in turn should lead to healthy PAT growth on a sequential basis. Jio Financial Services continues to make strategic moves such as launching digital products and expanding its ecosystem, with a clear focus on future growth. The company has announced plans to introduce products for lending against stocks and mutual funds, leveraging Jio’s large user base, which could be a significant growth driver in the coming quarters.”

“Furthermore, with the NBFC receiving RBI approval to become a primary investment company, Jio Financial Services is well-positioned to unlock value from its investments. Overall, we expect the company to report robust numbers in the upcoming quarter,” the StoxBox expert added.

Jio Financial Stock Target Price

Speaking about the technical outlook of Jio Financial share price, Ganesh Dongre, Senior Manager, Technical Research at Anand Rathi, said, “Jio Financial Services share price is poised to make a fresh high at the ₹260 apiece level. If the stock breaks above this mark, the Reliance Group stock could make a fresh high by touching the ₹290-₹295 zone. Hence, those with Jio Finance stock in their portfolio are advised to stick to the script by keeping a stop loss at ₹205. If the stock breaks above ₹260 decisively, then one can upgrade the stop loss at ₹240 for the near-term target of ₹295.”

On the advice to new buyers regarding Jio Financial stock, Ganesh Dongre said, “New buyers are advised to wait for the breakout. Once the stock breaks above ₹260, one can buy this Reliance Group stock at the short term target of ₹295, keeping a stop loss of ₹240 apiece.”

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage firms, and not of Mint. Investors are advised to consult with certified experts before making any investment decisions.

3.6 Crore Indians visited in a single day choosing us as India’s undisputed platform for General Election Results. Explore Latest Updates here!

Topics that may interest you

-

DeFi1 year ago

DeFi1 year agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News1 year ago

News1 year agoLatest Business News Live Updates Today, July 11, 2024

-

DeFi1 year ago

DeFi1 year agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Fintech1 year ago

Fintech1 year agoFinTech LIVE New York: Mastercard and the Power of Partnership

-

DeFi1 year ago

DeFi1 year agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

Fintech1 year ago

Fintech1 year ago121 Top Fintech Companies & Startups To Know In 2024

-

ETFs1 year ago

ETFs1 year agoGold ETFs see first outing after March 2023 at ₹396 cr on profit booking

-

DeFi1 year ago

DeFi1 year agoTON Network Surpasses $200M TVL, Boosted by Open League and DeFi Growth ⋆ ZyCrypto

-

Fintech1 year ago

Fintech1 year agoFintech unicorn Zeta launches credit as a UPI-linked service for banks

-

ETFs1 year ago

ETFs1 year agoLargest US Bank Invests in Spot BTC ETFs While Dimon Remains a Bitcoin Hater ⋆ ZyCrypto

-

News1 year ago

News1 year agoSalesforce Q1 2025 Earnings Report (CRM)