News

China’s US$8.5 billion in steel encourages Latin America to adopt tariffs

(Bloomberg) — One after another, Latin American countries are following in the footsteps of the U.S. and Europe by imposing prohibitive tariffs on Chinese imports — a strain on what has been an otherwise welcoming relationship.

Bloomberg’s Most Read

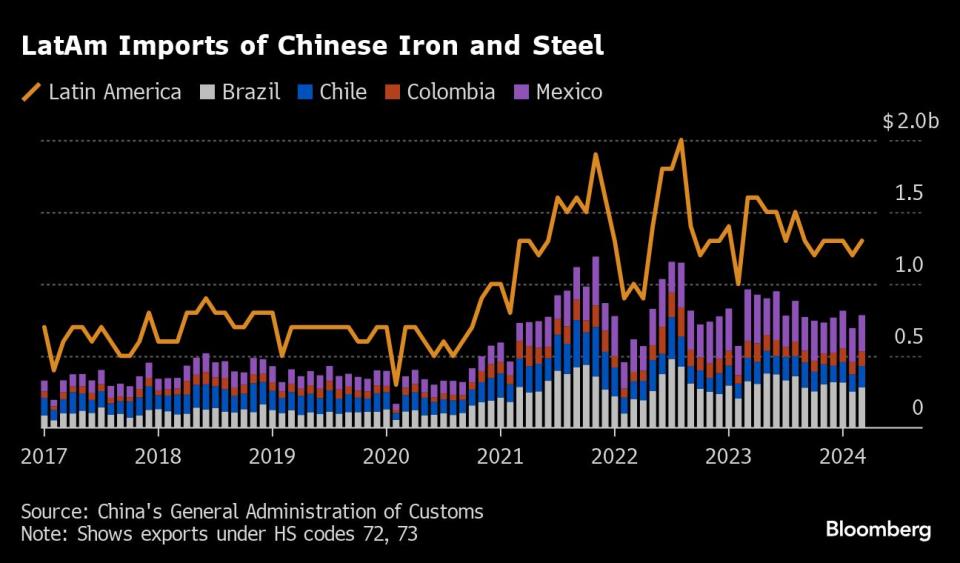

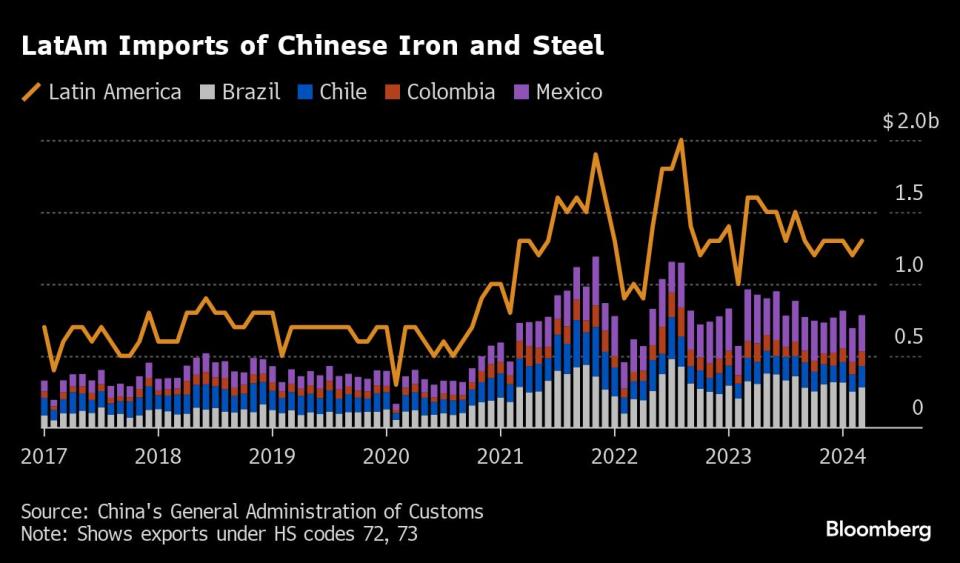

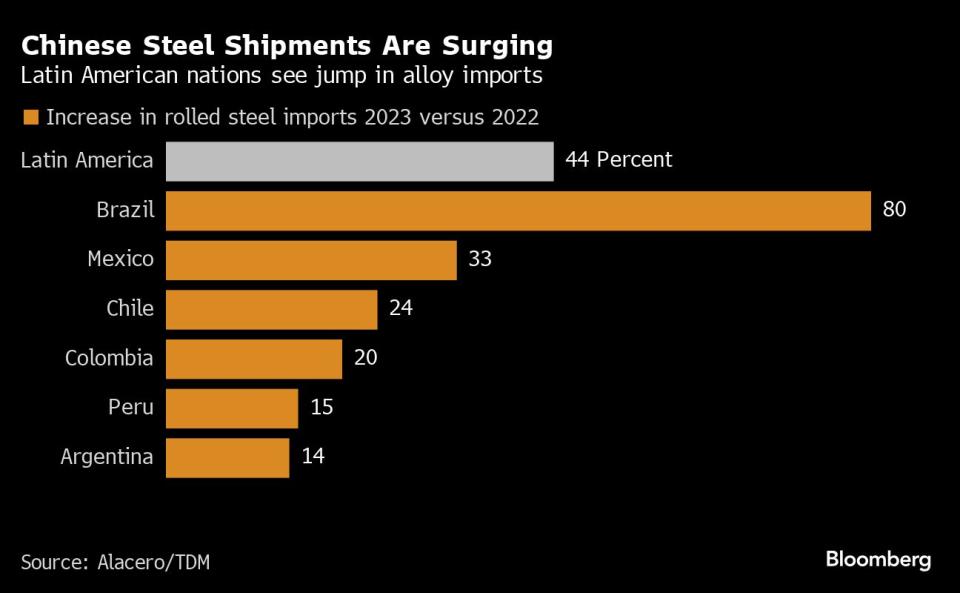

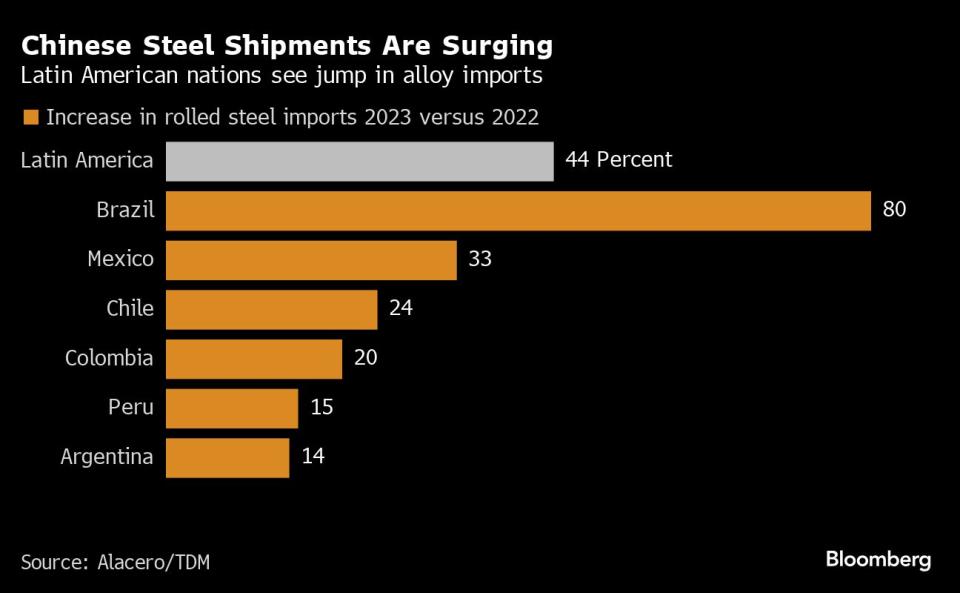

Mexico, Chile and Brazil have increased – and in some cases more than doubled – tariffs on steel products from China in recent weeks. Colombia may be about to follow suit.

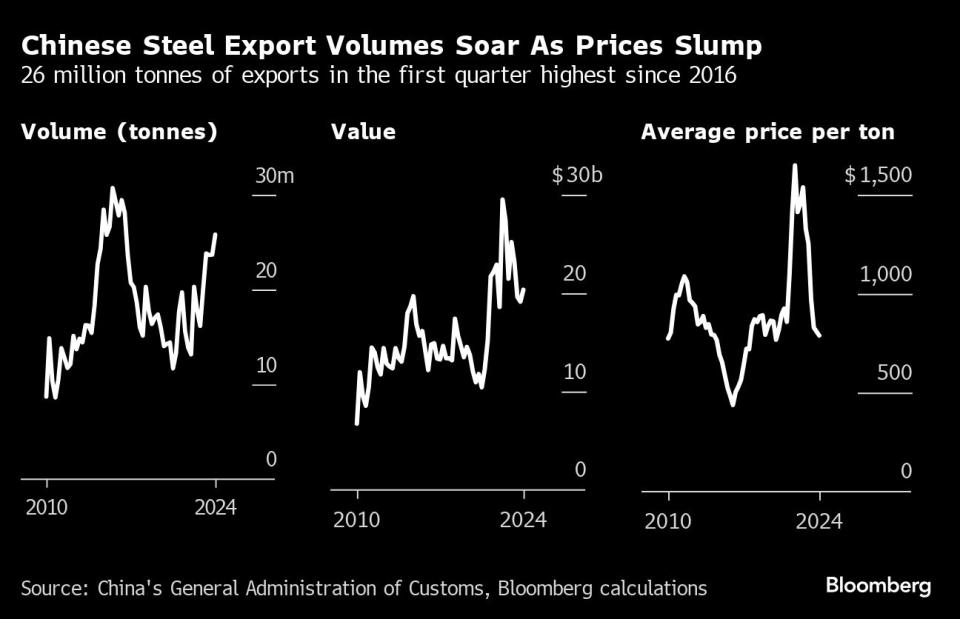

The fees may seem unfashionable given the way the Asian superpower has consolidated itself in Latin America in recent years. China has become the region’s largest buyer of raw materials and a major investor. At the same time, Latin America has given China another market to sell its products as it faces tough tariffs from the US and Europe. It is shipping nearly 10 million tons of steel a year, valued at $8.5 billion, to Latin America – a huge jump from a mere 80,500 tons in 2000, according to regional steel association Alacero.

Now, that relationship is being tested by a global turn toward protectionism and a flood of Chinese imports that threaten to drive Latin American steel producers out of business and put 1.4 million jobs at risk.

“This is an important test of China’s interests and intentions,” said Margaret Myers, director of the Asia and Latin America Program at the Inter-American Dialogue. It is also a “test of Latin America’s determination to challenge what is a critical economic partner”.

Brazil will soon introduce a tariff quota system to prevent predatory pricing of imported alloys. Although the official announcement did not mention China, the 62% increase in Chinese shipments last year to 2.9 million tonnes was behind the move, people familiar with the matter said.

“It’s a sign to the world that Brazil has rules – it’s not a no man’s land,” said Marco Polo de Mello Lopes, president of the industrial association Aço Brasil, who held talks with the government for nine months before it announced the new rules. .

However, reacting against China can be fraught with risk – especially for smaller, export-oriented economies that depend on Chinese demand for their sales of raw materials, from cherries to copper.

There are many examples of Beijing suspending purchases and investments in reaction to what it considers unfair and unilateral measures. There was a brief period during which China banned soy products from Argentina in response to broad anti-dumping measures. Following the arrest of a Huawei executive in Vancouver in 2018, China blocked canola shipments from two Canadian companies.

The story continues

China’s Ministry of Commerce did not respond to a request for comment on recent tariffs imposed by Latin American countries.

For the self-proclaimed leader of the Global South, there is also a broader symbolic risk that comes from a potential united front against its exports.

“In some ways, these developing countries are the best indicators of global trade sentiment toward China,” said Christopher Beddor, deputy director of China research at Gavekal Dragonomics. “They suggest that protectionist walls against Chinese products are being erected in many different places, not just in rich countries.”

Existential crisis

Latin America’s trade relationship with China has also, in many ways, had a positive impact on the region.

Chile’s economy, for example, has benefited greatly from sending raw materials to China and buying back processed or manufactured products. The country’s free trade strategy – including bilateral agreements with China and the US – has opened huge markets for its grapes, wines, salmon, wood pulp and minerals, helping it become one of the region’s most prosperous nations. .

But like other raw materials export-oriented economies, Chile has struggled to compete in downstream markets – such as turning raw lithium into battery components or iron ore into steel products.

For Brazil, having the best iron ore deposits in the world is not enough to make its steel mills competitive with China, even though it has developed some production capacity.

Take as an example the mining company Vale SA, which extracts rich iron ore from the red earth of the Brazilian Amazon. Much of it is transported 16,000 kilometers to the Chinese port of Qingdao and fed into any of the country’s hundreds of large steel plants. There it is sandblasted and shaped into basic alloy products.

The problem is that when some of this steel makes the return trip, it reaches Brazilian manufacturers at a huge discount compared to the prices charged by local steel mills owned by Gerdau, CSN and ArcelorMittal.

In Colombia, where Chinese shipments arrive at a 50% discount, steelmaker Paz del Río asked the government to increase import tariffs and help it return to profitability, CEO Fabio Galán said in an interview last month. The influx of Chinese alloys is not only putting jobs at risk, but has also completely displaced imports from Brazil and Mexico, according to the company. In the year to April, 92% of steel wire imports came from China and Russia.

“The biggest risk is that steel becomes another example for the argument that China is exporting its excess capacity,” Beddor said. “It’s especially a problem because steel could lead developing countries to buy into that narrative in a way they wouldn’t for, for example, electric vehicles.”

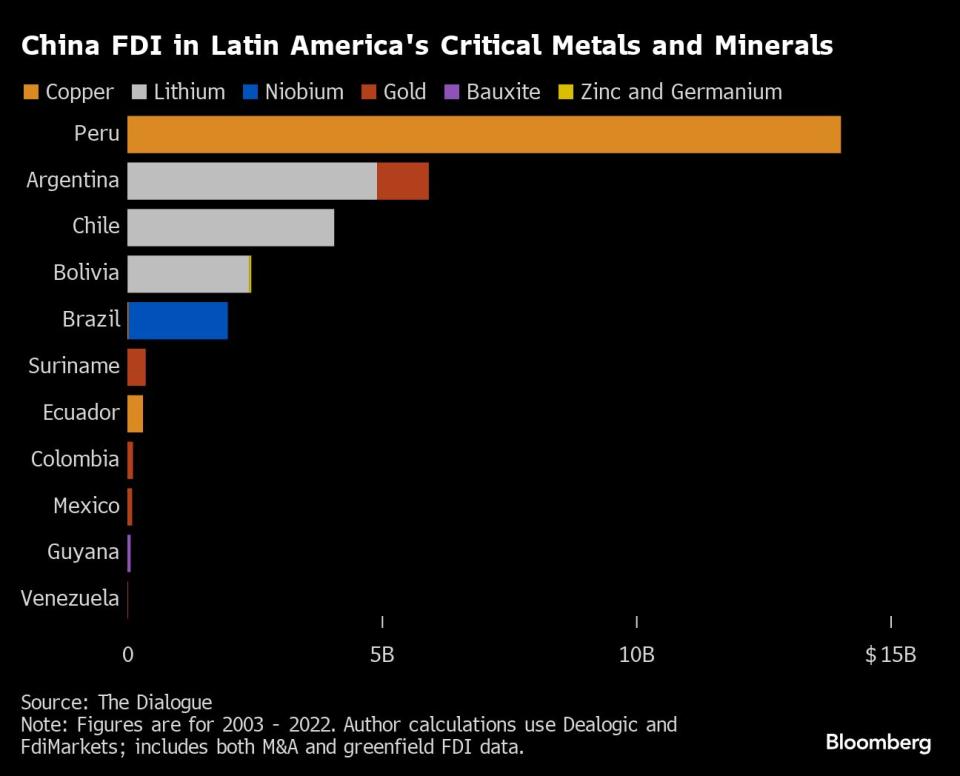

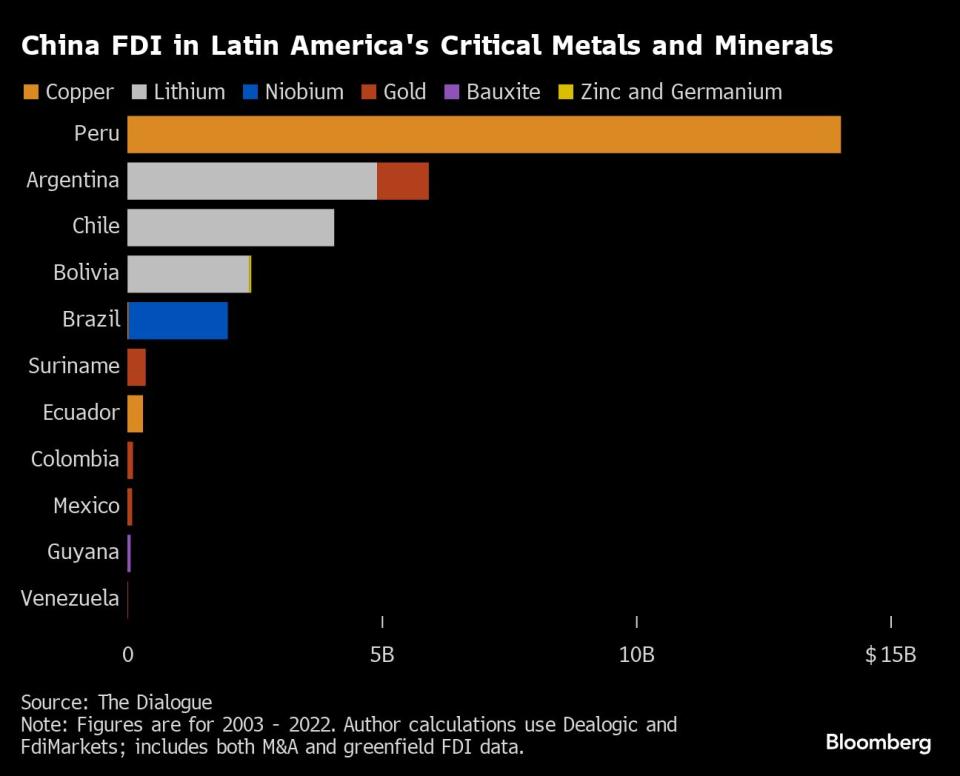

At the same time, Chinese investors have also been a key partner for Latin American countries looking to take their raw materials-oriented economies further downstream. The country has become a big spender in Latin America and the Caribbean, investing US$187.5 billion between 2003 and 2022 in industries such as energy, transport and mining, according to a report by the Inter-American Dialogue.

Although Chinese spending in the region has slowed of late, investment has continued in key industries. The Industrial and Commercial Bank of China grew in Argentina. In Brazil, electric car giant BYD Co. is building its first factory outside Asia and plans to announce another in Mexico by the end of the year. In Chile, BYD and Tsingshan are developing lithium cathode factories. Since 2005, the China Development Bank and the Export-Import Bank of China have provided $136 billion in loan commitments to the region.

With the recently imposed tariffs, Latin American countries may be betting that China is now so entrenched in the region that Beijing will not engage in reprisals. President Xi Jinping is expected to make his first trip to South America in five years for the APEC and G-20 leaders’ summits, putting a renewed focus on relations in the region.

Furthermore, although the amount of Chinese steel entering Latin America is significant for the region and detrimental to local factories, it represents about 1% of the billion metric tons that Chinese factories produce every year. This could minimize the risk of angering Beijing.

“These countries potentially have more influence than in the past because they are more critical as a destination for many of these goods,” Myers said. “That said, they are still hugely dependent on China. So everyone is going to walk this fine line.”

‘Bandage’

For Latin American steel-producing countries, tariffs are still not a perfect solution.

For example, strict new tariffs in Chile will increase costs in the all-important mining industry that uses steel balls to grind ore.

“It is necessary to show a response to the dilemmas caused by economic globalization,” said Francisco Urdinez, director of Nucleo Milenio Iclac, a Chile-based think tank that studies Sino-Latin American relations. “But it is not a fundamental solution. It’s just a band-aid that ends up generating redistribution from consumers to producers.”

Then, of course, there is the issue of steel dumping, the practice of selling the product for much less than local competitors. Raising tariffs won’t be enough to stop Brazil, said Humberto Barbato, who heads the country’s electronics industry association, Abinee, a major steel consumer. Instead, the government should prioritize purchasing products with local content, he said. “The Chinese have a lot of flexibility to change the price.”

Although top Brazilian steelmaker Gerdau applauded the country’s new tariff quota, CEO Gustavo Werneck warned that it would not solve the local industry’s long-term competitiveness problem, such as the high cost of energy.

“China will make exports an important source of financing” for the country’s transition from industrialization to a more consumption-oriented economy, Werneck told journalists at a press conference.

In total, Latin America’s steel protections are much more limited than the tariffs that former President Donald Trump implemented during his administration. This only makes it more likely that China will simply try to plead its cases at the World Trade Organization, according to University of Queensland associate professor Scott Waldron.

“Any countermeasures will be limited,” Beddor said.

According to him, authorities have already “started restricting steel production, and that will likely be the main focus in the future, rather than how to retaliate against upset trading partners.”

—With assistance from Joe Deaux, Fabiola Zerpa, Simone Iglesias, Fran Wang, James Mayger and Jenni Marsh.

Bloomberg Businessweek Most Read

©2024 Bloomberg LP

News

Breakfast on Wall Street: The Week Ahead

The spotlight next week will shift somewhat to the Federal Reserve’s second-quarter earnings season and monetary policy. Market watchers will be treated to results from several major names, including Dow 30 components Goldman Sachs (GS), UnitedHealth (UNH), Johnson & Johnson (JNJ) and American Express (AXP), along with streaming giant Netflix (NFLX).

The Fed will still attract some attention as investors will be eager to hear from a packed lineup of central bank speakers just before the policy meeting lockout period.

In terms of the economic calendar, after fifteen days of labor market and inflation indicators, activity data will gain momentum in the form of the latest retail sales and industrial production reports.

Earnings Highlight: Monday, July 15 – Goldman Sachs (GS) and BlackRock (Black). See the full earnings calendar.

Earnings Highlight: Tuesday, July 16 – UnitedHealth (UNH), Bank of America (BAC), Progressive (PGR), Morgan Stanley (IN), PNC Financial (PNC) and JB Hunt Transport (JBHT). See the full earnings calendar.

Earnings Highlight: Wednesday, July 17 – Johnson & Johnson (JNJ), US Bancorp (USB), Morgan Children (KMI), United Airlines (UAL) and Ally Financial (ALLY). See the full earnings calendar.

Earnings Highlight: Thursday, July 18 – Netflix (NFLX), Abbott Laboratories (ABT), Black stone (BX), Domino’s pizza (ZDP) and Taiwan Semiconductor Manufacturing (TSM). See the full earnings calendar.

Earnings Highlight: Friday, July 19 – American Express (AXP), Halliburton (THANKS) and Travelers (VRT (return to recoverable value)) See the full earnings calendar.

IPO Observation: Hospital and healthcare clinic operator Ardent Health Partners (TARDT), insurance service provider Twfg (TWFG) and the biotechnology company Lirum Therapeutics (LRTX) are expected to price their IPOs and begin trading next week. The analyst quiet period ends at Rectitude (RECT) to free up analysts to publish ratings.

News

Trump shooting: Gold could hit record high, dollar and cryptocurrencies set to jump

Police cars outside the residence of Thomas Matthew Crooks, the suspected shooter at a Trump rally on Saturday, investigate the area in Pennsylvania. Following the incident, one rally attendee was killed, two rally attendees are in critical condition and Donald Trump suffered a non-fatal gunshot wound. The shooter is dead after being shot dead by the United States Secret Service. (Photo by Kyle Mazza/Anadolu via Getty Images)

Investors will initially favor traditional safe-haven assets and may lean toward trades more closely tied to former President Donald Trump’s chances of winning the White House after he survived an assassination attempt, according to market watchers.

“There will undoubtedly be some protectionist or safe-haven flows into Asia early this morning,” said Nick Twidale, chief market analyst at ATFX Global Markets. “I suspect gold could test all-time highs, we’ll see the yen being bought and the dollar, and flows into Treasuries as well.”

Early market commentary suggested Trump’s shooting at a rally in Pennsylvania on Saturday could also prompt traders to increase his likelihood of success in the November election. His support for looser fiscal policy and higher tariffs is generally seen as likely to benefit the dollar and weaken Treasuries.

An indicator of market sentiment heading into the weekend: Bitcoin surged above $60,000, likely reflecting Trump’s pro-crypto stance.

Other assets positively linked to the so-called Trump trade include stocks of energy companies, private prisons, credit card companies and health insurers.

Traders will also be closely watching market measures of expected volatility on Monday, such as those in the tariff-sensitive Chinese yuan and Mexican peso, which have begun to price in the U.S. vote.

Trump said he was shot in the right ear after a shooting at his rally. His campaign said in a statement that he was “fine” after the incident, which prompted him to rush off the stage.

“Currencies will be the first major market on Monday in Asia to react to the weekend’s shots. There’s potential for extra volatility, and getting a clear reading could be especially difficult because liquidity will be hurt by Japan’s national holiday,” said Garfield Reynolds, Asia team leader for Bloomberg Markets Live.

Strategists had already expected a volatile run-up to the election, particularly as Democrats are still agonizing over President Joe Biden’s candidacy after his poor performance in last month’s debate raised questions about his age. Investors were also grappling with the possibility that the election could end in a drawn-out dispute or political violence.

But there is little precedent for events like those in Pennsylvania. When President Ronald Reagan was shot four decades ago, the stock market plunged before closing early. The next day, March 31, 1981, the S&P 500 rose more than 1% and benchmark 10-year Treasury yields fell 9 basis points to 13.13%, according to data compiled by Bloomberg.

Bond investors should pay particular attention as the attack is likely to boost Trump’s election chances and ultimately lead to concerns about the fiscal outlook, according to Marko Papic, chief strategist at California-based BCA Research Inc.

“The bond market must at some point become aware of President Trump’s greater chances of winning the White House than any of his rivals,” Papic wrote. “And I continue to believe that as his chances increase, so too must the likelihood of a bond market revolt.”

Kyle Rodda, senior financial markets analyst at Capital.com, said he was seeing client flows into Bitcoin and gold following the shooting.

“This news marks a turning point in American policy norms,” he said. “For markets, it means safe-haven trades, but more tilted toward non-traditional safe-havens.”

News

Latest Business News Live Updates Today, July 11, 2024

Follow us for stories on Bill Gates, Elon Musk, Mukesh Ambani, Gautam Adani as we bring you everything that’s happening in the business world. Follow the latest gold and silver prices here too. Stay in the know on all things business with us.

Latest news on July 11, 2024: Airtel says its new Xstream Fiber plans bundle over 350 live TV channels (Official Photo) (Reuters) Disclaimer: This is an AI-generated live blog and has not been edited by Hindustan Times staff.

Follow all the updates here:

-

Thu, 11 Jul 2024 08:44 PM

Business News LIVE Updates: Decoding Airtel’s new Xstream Fiber packages, finding value with Live TV and OTT

- Airtel confirms to HT that the live TV proposition is being delivered using its DTH network, while the bundled streaming subscriptions are an extension of its Xstream Play platform.

-

Thu, 11 Jul 2024 03:58 PM

Business News LIVE Updates: TCS Q1 results meet estimates: Net profit up 9%, ₹10 dividend declared

- TCS’s consolidated revenue rose 5.4% to Rs 626.13 billion in the June quarter. Analysts had expected revenue of Rs 622.07 billion, as per LSEG data.

-

Thu, 11 Jul 2024 03:51 PM

Business News LIVE Updates: Indian companies falsified generic Viagra data to get approval, says US FDA: Report

- Synapse Labs Pvt. Ltd may have been used in hundreds of drugs that are still available for sale, the report said.

-

Thu, 11 Jul 2024 03:09 PM

LIVE Business News Updates: Namita Thapar’s emotional post on Emcure IPO listing: ‘Mirza Ghalib sums up my feelings’

- Emcure Pharmaceuticals was listed at ₹1,325.05, up 31.45% on the BSE and NSE on July 10.

-

Thu, 11 Jul 2024 02:39 PM

LIVE business news updates: Amazon could face investigation over treatment of UK food suppliers, watchdog says

- An Amazon spokesperson said the company has made several improvements for food suppliers since last year’s results.

-

Thu, 11 Jul 2024 01:39 PM

LIVE Business News Updates: This Bengaluru company aims to launch a ‘space habitat’ by 2027, in talks with SpaceX

- AkashaLabdhi calls itself a “home among the stars” as it says the company’s area of expertise is signal processing and continuous automation.

-

Thu, 11 Jul 2024 01:10 PM

Business News LIVE Updates: Amazon India employees on working conditions: Made to stand for hours, bathroom breaks not allowed

- A survey conducted by UNI Global Union with the Amazon India Workers Association had 1,838 participants who alleged appalling working conditions at Amazon facilities in India.

-

Thu, 11 Jul 2024 12:44 PM

LIVE Business News Updates: UK overhauls listing rules in bid to attract IPOs to London: What has changed?

- The new rules allow companies to carry out more activities without putting them to a shareholder vote, the UK’s Financial Conduct Authority said.

-

Thu, 11 Jul 2024 12:18 PM

Business News LIVE Updates: Want to send money abroad? Open foreign currency accounts at GIFT City

- Foreign currency accounts will be like a bank account in India, but instead of rupees, you hold foreign currency like US dollars.

-

Thu, 11 Jul 2024 11:30 AM

Business News LIVE Updates: First Abu Dhabi Bank denies interest in acquiring stake in Yes Bank: Report

- The report said the Yes Bank stake sale has attracted interest from Japan, including Mitsubishi UFJ Financial Group Inc. and Sumitomo Mitsui Financial Group Inc.

-

Thu, 11 Jul 2024 11:04 AM

LIVE Business News Updates: TCS Share Price Surges Ahead of Q1 Results: What Brokers Say About the Stock

- TCS Share Price: The stock opened at ₹3,944.65 against its previous close of ₹3,909.90. It then rose 1.8 percent to ₹3,979.90 level.

-

Thu, 11 Jul 2024 10:22 AM

LIVE Business News Updates: Reliance Jio IPO listing likely in 2025 at $112 billion valuation: Jefferies

- Jio “could list at a valuation of $112 billion” and add “7-15 percent upside” to Reliance Industries’ share price, Jefferies said.

-

Thu, 11 Jul 2024 09:42 AM

LIVE Business News Updates: Yes Bank shares rise after Moody’s revises outlook to ‘positive’ from ‘stable’

- Global rating agency Moody’s has raised its outlook on Yes Bank to positive from “stable” despite expectations of a gradual improvement in its depositor base.

-

Thu, 11 Jul 2024 09:16 AM

Business News LIVE Updates: Sahaj Solar IPO opens today: All you need to know before subscribing to the issue

- Sahaj Solar IPO: The block issue aims to raise ₹52.56 crore through issuance of 2.92 million new shares and will close on July 15.

-

Thu, 11 Jul 2024 08:40 AM

LIVE Business News Updates: Why Analysts Believe India’s Earnings Season May Disappoint Stock Market Investors

- Investors in Indian stocks hoping for a robust earnings season to justify expensive valuations are likely to be disappointed.

-

Thu, 11 Jul 2024 08:35 AM

LIVE Business News Updates: Elon Musk Says Second Neuralink Brain Implant Will ‘Give People Superpowers’ Within a Week

- Elon Musk said Neuralink will make some changes to try to alleviate the problem of its electrode wires retracting from brain tissue.

-

Thu, 11 Jul 2024 07:59 AM

LIVE Business News Updates: Apple warns Indian iPhone users of possible Pegasus-like ‘spyware attack’

- In April this year, the Indian Computer Emergency Response Team (Cert-In) flagged several vulnerabilities in Apple’s operating system for iPhone and iPad.

-

Thu, 11 Jul 2024 07:45 AM

Business News LIVE Updates: US stock markets at record highs led by world’s biggest tech companies

- The Philadelphia Semiconductor Index rose 2.4% to a record high after Taiwan Semiconductor Manufacturing Co. reported strong quarterly revenue.

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

{{^userSubscribed}} {{/userSubscribed}} {{^userSubscribed}} {{/userSubscribed}}

News / Business / Latest Business News Live Updates Today, July 11, 2024

Source

News

Jio Financial share price: Should you buy this Reliance group stock on Monday ahead of Q1 FY2024 results?

Q1 2024 Results: Jio Financial Share Price will be in focus on Monday as the Reliance Group company has a fixed board meeting on July 15, 2024 to consider and approve the company’s unaudited standalone and consolidated financial results. Trust Group company informed about the Q1 2024 Results date on Wednesday last week via an exchange filing. According to stock market experts, Jio Financial Services Limited is poised to deliver impressive Q1 results for FY25 on solid operating income. They have forecast a healthy QoQ PAT for the company in Q1 FY25.

Jio Financial Services News

Speaking on the Jio Financial Services Q1 2024 results, Manish Chowdhury, Head of Research, StoxBox, said, “We believe Jio Financial Services is poised to deliver impressive results in Q1FY25 aided by its operating income, which is likely to show robust growth driven by strong investment income, which in turn should lead to healthy PAT growth on a sequential basis. Jio Financial Services continues to make strategic moves such as launching digital products and expanding its ecosystem, with a clear focus on future growth. The company has announced plans to introduce products for lending against stocks and mutual funds, leveraging Jio’s large user base, which could be a significant growth driver in the coming quarters.”

“Furthermore, with the NBFC receiving RBI approval to become a primary investment company, Jio Financial Services is well-positioned to unlock value from its investments. Overall, we expect the company to report robust numbers in the upcoming quarter,” the StoxBox expert added.

Jio Financial Stock Target Price

Speaking about the technical outlook of Jio Financial share price, Ganesh Dongre, Senior Manager, Technical Research at Anand Rathi, said, “Jio Financial Services share price is poised to make a fresh high at the ₹260 apiece level. If the stock breaks above this mark, the Reliance Group stock could make a fresh high by touching the ₹290-₹295 zone. Hence, those with Jio Finance stock in their portfolio are advised to stick to the script by keeping a stop loss at ₹205. If the stock breaks above ₹260 decisively, then one can upgrade the stop loss at ₹240 for the near-term target of ₹295.”

On the advice to new buyers regarding Jio Financial stock, Ganesh Dongre said, “New buyers are advised to wait for the breakout. Once the stock breaks above ₹260, one can buy this Reliance Group stock at the short term target of ₹295, keeping a stop loss of ₹240 apiece.”

Disclaimer: The views and recommendations made above are those of individual analysts or brokerage firms, and not of Mint. Investors are advised to consult with certified experts before making any investment decisions.

3.6 Crore Indians visited in a single day choosing us as India’s undisputed platform for General Election Results. Explore Latest Updates here!

Topics that may interest you

-

DeFi11 months ago

DeFi11 months agoSwitchboard Revolutionizes DeFi with New Oracle Aggregator

-

News11 months ago

News11 months agoLatest Business News Live Updates Today, July 11, 2024

-

DeFi11 months ago

DeFi11 months agoIs Zypto Wallet a Reliable Choice for DeFi Users?

-

DeFi1 year ago

DeFi1 year ago👀 Lido prepares its response to the recovery boom

-

Fintech11 months ago

Fintech11 months agoFinTech LIVE New York: Mastercard and the Power of Partnership

-

DeFi11 months ago

DeFi11 months agoEthena downplays danger of letting traders use USDe to back risky bets – DL News

-

Fintech1 year ago

Fintech1 year ago121 Top Fintech Companies & Startups To Know In 2024

-

Fintech1 year ago

Fintech1 year agoFintech unicorn Zeta launches credit as a UPI-linked service for banks

-

News1 year ago

News1 year agoSalesforce Q1 2025 Earnings Report (CRM)

-

ETFs1 year ago

ETFs1 year agoGold ETFs see first outing after March 2023 at ₹396 cr on profit booking

-

Videos1 year ago

Videos1 year ago“We will enter the ‘banana zone’ in 2 WEEKS! Cryptocurrency prices will quadruple!” – Raoul Pal

-

Videos1 year ago

Videos1 year ago“BlackRock HAS UNLEASHED a massive multi-trillion monster” – Lyn Alden and Eric Balchunas